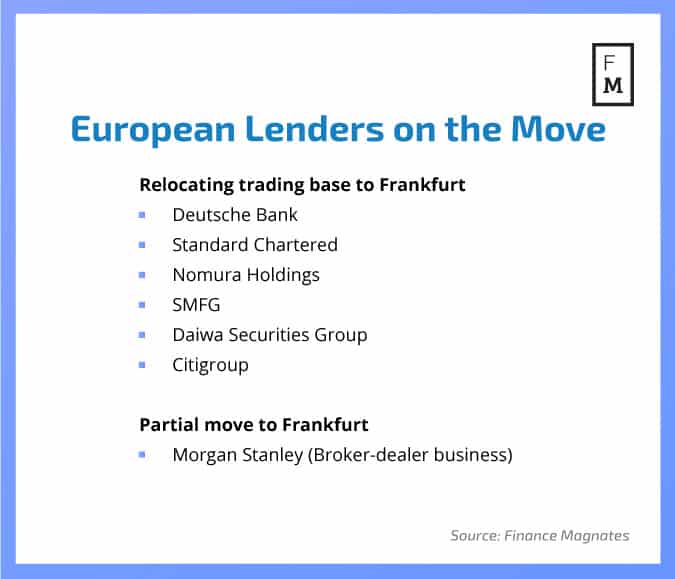

Citigroup has moved forward with its plans to relocate its EU base of operations post-Brexit , honing in on Frankfurt as its newest Hub . The decision was preceded by months of contemplation for the US lender. Most other banks operating in the UK are also considering such a move as they wait for cues from the Brexit negotiations.

The London Summit 2017 is coming, get involved!

Citigroup joins Morgan Stanley, which last month became the first US bank to decide on Frankfurt as its future EU trading nexus following Brexit. The timing was ultimately dictated by the Bank of England calling for a mid-July deadline for UK-based banks to provide the regulator with detailed plans about their Brexit strategy. This coincided with a string of recent announcements from a plethora of lenders all publicizing their plans after months of chatter.

Frankfurt skyline

Reuters

Targeted move

Unlike other lenders that are planning a more substantial overhaul or relocation of personnel, Citigroup plans to create only between 150 and 250 new roles in the German city, according to a Bloomberg report. It is presently unclear if these roles will be filled by existing personnel in the UK or will be hired in Frankfurt.

Frankfurt itself does boast many inherent advantages, namely its geo-strategic location in the bloc and talented labor pool. Frankfurt has also opened up its arms to prospective lenders, offering to relax rigid labor laws and give banks more flexibility to make people redundant.

Interestingly, the decision was initially caused by the likely cessation of passporting rights to the UK. However, while UK PM Theresa May has insisted that passporting would be curtailed for lenders, her recent electoral setbacks have led to signs of a softened Brexit, leading to a potential bid to retain these rights.

A two-horse race has now emerged from the original selection of EU cities that threatened London’s status as Europe’s financial capital. Frankfurt and Dublin are now the front runners, securing the biggest names to date. Moving forward, it will be interesting to see if Frankfurt’s dearth of office space, seen as a potential Achilles' heel for broader relocation efforts, will be a factor for other lenders not yet decided on their relocation plans.