Credit Suisse has pledged to accelerate its cost cutting efforts after disappointing results throughout 2015. The financial institution is now aiming to restructure its business in order to return to profitability after losing close to $3 billion last year.

The company has also announced that the consolidation process of its Global Markets division will include a consolidation of the FX Cash and FX Options businesses into the STS operations of Credit Suisse, which are part of the Swiss Universal Bank.

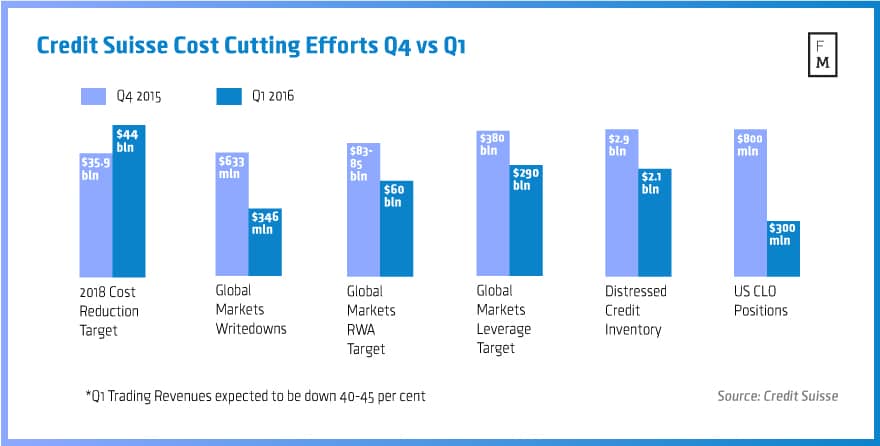

In addition, the Swiss bank has announced that it is increasing cost cutting efforts by about $820 million. The move includes another 30 per cent cut to the Global Markets division of Credit Suisse. The move comes after the firm announced that it is writing off $346 million in the first quarter related to the same line of business of the Swiss bank.

Cost cutting efforts in numbers, Source: Credit Suisse

The company’s market capitalization has been reduced by a third since the start of 2016 after tumultuous European credit markets have prompted a selloff in bank shares across the continent.

The company’s CEO Tidjane Thiam stated: “Our performance has highlighted two key areas of challenges for Credit Suisse: our fixed cost base and our scale in Global Markets in the Americas and Europe.”

A short look at the statement of Thiam reveals that most of the cuts will be in Europe and in the Americas, with the Asian Global Markets division remaining intact for now.

Credit Suisse is planning to achieve gross annual savings costs of $4.4 billion by 2018, which is up from the firm’s previous estimate of about $3.6 billion. The firm is also aiming to reduce its risk weighted assets in the company’s Global Markets division to $60 billion by the end of the current calendar year, which is lower by $25 billion when compared previous estimates.

The future shape of the Global Markets division of Credit Suisse includes the firm’s Equities business, a restructured credit business and a solutions platform. The Swiss bank is exiting Distressed Credit, European Securitized Product trading and Long-Term Illiquid Funding and will reduce capital allocation to other lines of business.

“Equities will remain a core area of focus for the bank and we will continue to build on our leading Cash, Prime and ECM franchises,” a Credit Suisse statement reads.

The cost base of the Global Markets division will be reduced from $6.77 billion at end-2015 to $5.54 billion by end-2018.