Credit Suisse has just reported its Q4 2017 financials and with it its full year earnings. The latest results continued to highlight a downturn for the banking industry, with the Swiss lender incurring its third straight annual loss. The major culprit was a US tax writedown, which has not exactly aligned with CEO Tidjane Thiam’s recovery plan.

Discover credible partners and premium clients at China’s leading finance event!

The banking sector as a whole had seen an up and down 2017. The beginning of the year started off on a positive note with major lenders in the midst of cost cutting strategies, scaling efforts, and other initiatives to spur profits. These measures were largely successful, for their part, though resulted in the losses of thousands of personnel cuts.

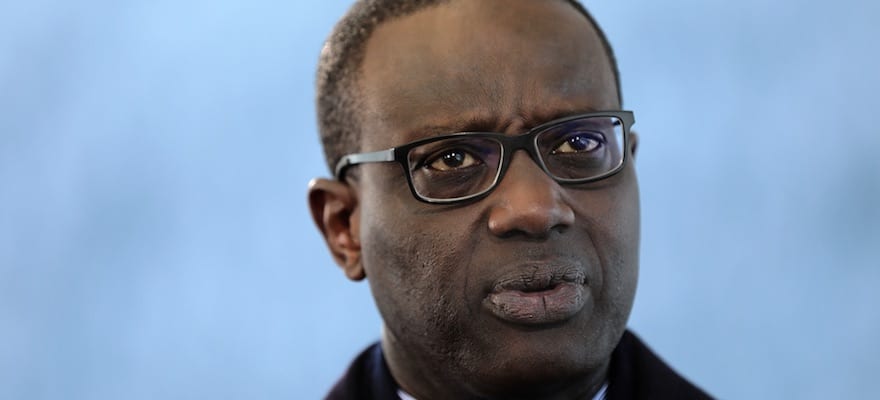

Credit Suisse's CEO, Tidjane Thiam

(Photo: Bloomberg)

Lingering concerns?

For Credit Suisse’s part, the group had dealt with issues surrounding bonuses back in April 2017. Like other lenders, Credit Suisse had seen its fair share of job cuts and the consolidation of key units. Thiam had originally kicked off a company-wide recovery plan back in 2015, though several issues came to the forefront in 2017.

A curious decision to expand the group’s bonus pool for executives proved to be unpopular with shareholders, causing blowback and an ultimate change of course. Later in year, Credit Suisse also managed to garner a successful capital raise of CHF 4.0 billion to help fortify its financial strength to a level that was on par with its rivals.

2018 however has been a different story. Already this year, Credit Suisse has closed the doors on one of its London offices in London’s Canary Wharf financial district. The move is more reflective of its current Brexit agenda, which is still unclear in terms of scope and costs.

The latest financials for the 2017 year also did not paint a very upbeat picture as well. Due in large part to changes in the US tax code led by the Trump administration, Credit Suisse’s 2017 profits took a serious hit.

For the third straight year, the company managed to record a yearly loss, with 2017 seeing a decline of $1.05 billion (CHF 983 million). The tax writedown in the US crippled Credit Suisse’s earnings, having amounted to $2.47 billion (CHF 2.3 billion) in 2017. Despite the loss, this figure bested street expectations, which had portended a loss of $1.18 billion (CHF 1.1 billion).

Consequently, Credit Suisse proposed a reduced dividend due to the initial effects of the tax writedown. This was proposed at just CHF 0.25 per share, relative to CHF 0.70 per share back in 2016 – this underperformed a composite of predictions of CHF 0.28 from street analysts. Of note, the group reported that it would be “adopting a cautious short-term outlook in this period of heightened Volatility .”

On a positive note, apart from the tax writedown, Credit Suisse’s segments have been performing well in 2017. Net new assets at its Wealth Management were on the rise to 37.2 billion CHF, with assets under management climbing by 13.0 percent in 2017 to a record CHF 772 billion.

Moving forward, Credit Suisse will look past its tax writedown to further stimulate its business and see increasing profits. “In the first six weeks of 2018, we have seen a significant pick-up in market volatility, which on the one hand had a positive impact on our secondary activities, and on the other hand, negatively impacted our primary calendar as clients wait for calmer markets in order to transact,” per a group statement.