Deutsche Bank, the biggest German lender and major foreign exchange Prime Broker , has reported its quarterly and full year results for 2016. The company’s net loss for the year narrowed down materially from €6.78 billion in 2015 to just over $1.35 billion last year.

The top German lender's net revenues for the fourth quarter of 2016 increased by 6 percent year-on-year to €7.1 billion. Revenues for the full year are 10 percent lower at €30.0 billion, due to a “challenging market environment” and a “persistent low interest rate environment”.

Commenting on the results, the company’s CEO, John Cryan, said: “Our results for the year 2016 were heavily impacted by decisive management action taken to improve and modernise the bank, as well as by market turbulence for Deutsche Bank. We finished 2016 with pleasingly strong capital and Liquidity ratios and we are optimistic after a promising start to this year.”

Deutsche Bank ends 2016 with a capital ratio of 11.9 percent which is the German lender’s strongest figure in twelve quarters. The figure is higher by 0.8 basis points from 11.1 percent at the end of the third quarter of 2016.

The Common Equity Tier 1 capital totals €42.7 billion, a figure that is lower by 3 percent. The German lender has its Total Loss Absorbing Capacity (TLAC) at €116 billion. Deutsche Bank managed to reduce its Risk Weighted Assets (RWA) by €39 billion to €358 billion.

The company’s liquidity reserves total €218 billion, increasing by €18 billion during the quarter.

Global Markets Revenues

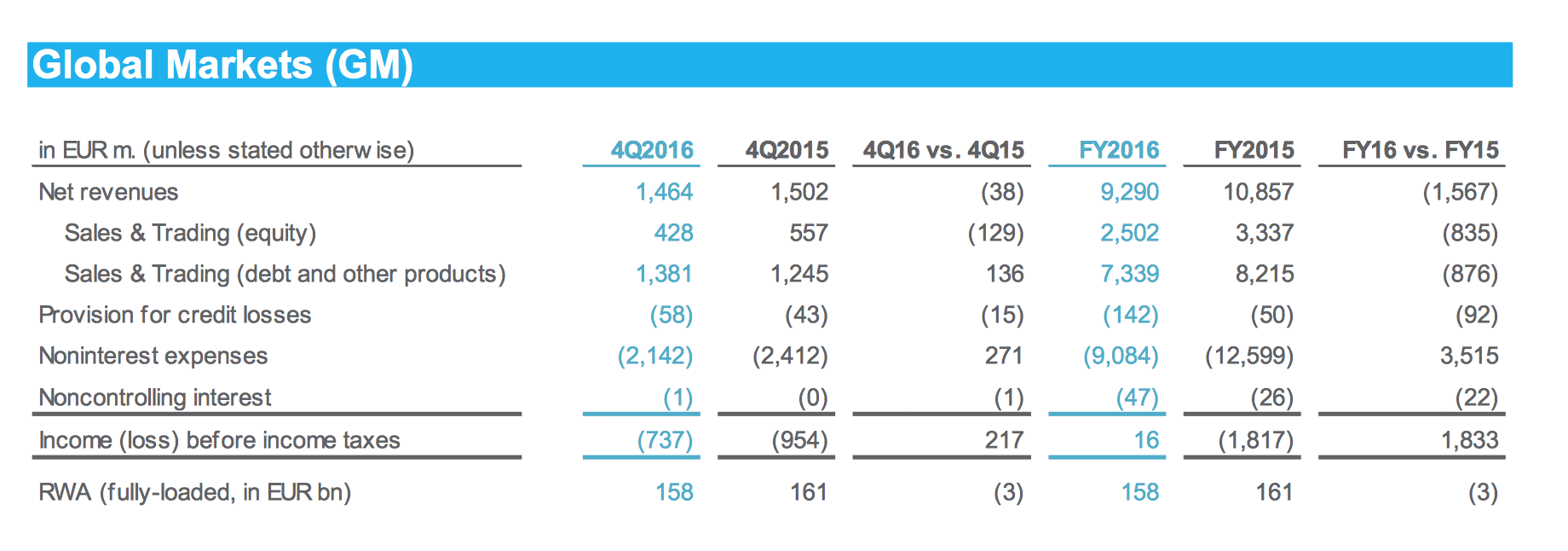

The company’s Global Markets (GM) revenues have been affected by the negative news flow around the US Department of Justice settlement in October 2016. Clients have pulled back on trading, and funding costs for Deutsche Bank have increased.

The Global Markets division of Deutsche Bank reports net revenues of €1.5 billion in the fourth quarter of 2016. The result is lower by 3 percent when compared to the same period in the prior year.

Deutsche Bank Global Markets Revenues, Source: Deutsche Bank Q4 2016 Earnings

For the full year GM revenues came out at €9.3 billion, which represents a 14 percent decline when compared to 2015. The company is stating that the lower figure is a result of “less favourable market conditions”, highlighting its equities business.

Deutsche Bank is also highlighting increased FX revenues from “higher client activity around the US election”. The company’s debt sales and trading revenues are higher due to the company’s strong credit business in the US.

Equity sales and trading revenues are below the level observed a year ago, driven by lower client activity and lower client balances. Those are partly offset by higher derivatives revenues.

Low ECB Rates Hampering Banking Sector Recovery

Deutsche Bank’s results serve to prove once more that the policy of the European Central Bank has been hampering growth across the European Union. Low rates are negatively affecting the banking business across the continent. Mario Draghi’s “whatever it takes” pledge has taken away initiative from governments across the continent to engage in material structural reforms.