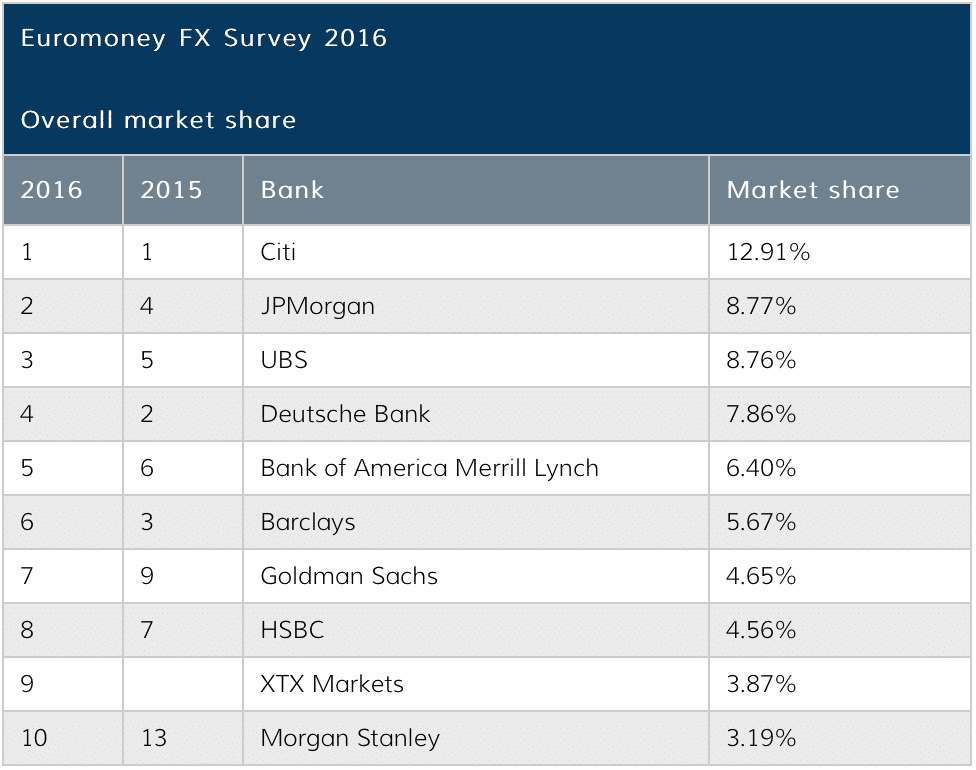

Citigroup has continued to hold the top ranking amongst currency trading companies in 2016 according to this year’s Euromoney Foreign Exchange survey. Aside from this, the changes across the table have been substantial.

The market share of the top 5 global banks for foreign exchange trading has decreased to 44.7 per cent of the volume. This marks a continuation of their decline after a peak of 61.5 per cent in 2009. Looking at the institutions which have ranked from 6th to 10th spot, their market share totaled about 22 per cent, a figure which is consistent with previous years.

For the first time ever, we are seeing a non-bank Liquidity provider in the top 10. XTX Markets managed to take away 3.87 per cent of the market share and ranked 9th, just before Morgan Stanley, which entered the top 10 after ranking 13th last year. XTX Markets was not even within the survey last year.

According to Zar Amrolia, Co-CEO at XTX Markets, in a recent statement on the findings, “We absolutely do not replace banks: banks will always be crucial for their full-service client relationships. We simply help the banks that we partner with do one part of their value chain more efficiently and profitably."

Other non-bank companies that made it into Euromoney’s FX Rankings this year and are ranked within the top 50 are Tower Research Capital, Jump Trading, Virtu Financial, Lucid Markets and Citadel Securities.

Deutsche Bank Woes Hit its FX Unit

Looking at the biggest decliners, the fortunes of Deutsche Bank have dropped dramatically with the company’s market share collapsing from 14.5 per cent in the 2015 survey to 7.9 per cent this year. Some of the company’s debt securities which have been widely sold off at the beginning of 2016 have been downgraded by Moody’s to two notches above junk status earlier this week.

The most alarming part of the results for Deutsche Bank is that its market share has almost halved within the past year. The biggest German lender previously held the top spot in the Euromoney Annual Survey of the foreign exchange market between 2005 and 2013.

Citi Extends Lead at the Top, JP Morgan Jumps into 2nd

Citigroup has managed to increase its lead over the second spot ranking JPMorgan which climbed from fourth spot in 2015 despite the overall decline in its market share, that declined to 12.91 per cent from 16.11 per cent last year.

JPMorgan leaped into second spot and has actually increased its market share from 7.65 per cent to 8.77%. The US bank has performed particularly well in the leveraged fund category where it held 18 per cent of the market. Looking at the electronic markets survey, the company jumped into second spot from fifth.

Top 10 Rankings in the Euromoney FX Survey 2016, Source: Euromoney