Investors will soon get the chance to invest in another fast-growing ETP (exchange-traded products) company, Flow Traders, which on Thursday announced its plan to float up to 40% of its shares on the Euronext Amsterdam Stock Exchange .

The HFT firm announced its plan to float up to 40% of its shares on the Euronext Amsterdam stock exchange.

Founded in 2004, the Dutch proprietary trading firm is a high-frequency trader (HFT), buying and selling ETPs in high volumes and making a profit on the spread. As a principal trading firm, it does do not have clients or offer investment services, rather, it trades on its own account - owning swathes of ETPs at any given moment.

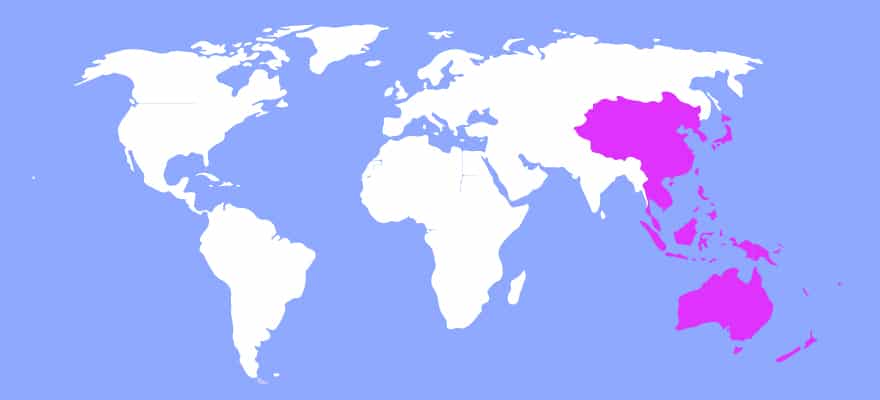

Headquartered in Amsterdam, the Netherlands, and with an in-house software development team located in Romania, Flow Traders is also active in Singapore and New York. The geographic coverage allows it to trade on 94 exchanges in 32 countries.

Growth has been 38% on average from 2012 to 2014 and more than doubled in the first three months of 2015.

Going Public

The decision to list its shares comes as no surprise. After selling a stake of the company to Summit Partners in 2008, the founders, Roger Hodenius and Jan van Kuijk, were hoping to cash-out in 2012, at which time they looked around for buyers to no avail, according to Bloomberg.

Since then, the company has seen impressive annual growth. 2012-2014 saw its net trading income grow by 38% on average, while trading revenues more than doubled in the first three months of 2015. The company is positioned as a major worldwide Liquidity provider.

Easing Headwinds

The initial public offering (IPO) will test the appetite among investors for HFT firms. Indeed, Michael Lewis’ book, Flash Boys, put the industry into disrepute, exposing how HFT traders skew the market by front running orders placed by investors.

The IPO will test the appetite among investors for HFT firms.

However, the industry’s reputation has rebounded somewhat since then. Most recently, the Bank of England highlighted the fact that HFT firms provide liquidity and efficiency in markets. According to the report, “HFT firms appear to be reacting simultaneously and quickly to new information as it arrives at the market place, which makes prices more efficient. This suggests that correlated trading by HFT firms does not appear to contribute to undue price pressure and price dislocations on a systematic basis…"

And the IPO is not without precedent. In April, US-based firm, Virtu (NASDAQ: VIRT), was the first HFT firm to go public, successfully raising $314 million, which represented the high-end of prior estimates. The company’s shares gained 20% on their first day of trading.

A Bumpy Ride?

With such strong precedent coupled with impressive growth and an apparently competent team, one would be forgiven for being optimistic about Flow Traders’ impending IPO. However, a number of question marks linger. Namely, while Virtu sought to raise money to grow and expand its business into China, the reason for the Flow Traders’ float is generally believed to simply represent an exit for the shareholders. Thus, the money raised will unlikely be invested back into the company.

However, a number of question marks linger.

Moreover, the Amsterdamtrader blog raises further questions regarding Flow Traders’ uncompetitive low-latency connection, its over-sized valuation (at around €1 billion, according to Bloomberg) and its rather strategically-limited business model.

Should the company go through with its IPO and successfully list on the Euronext Amsterdam stock exchange, it would be the first HFT firm to go public in Europe; certainly a space worth watching.