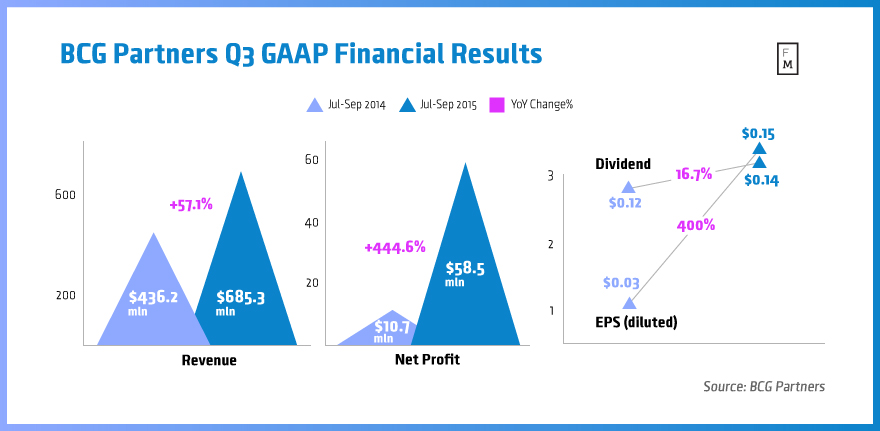

BGC Partners, the global financial services providers, reported today net earnings of $58.5 million for the third quarter of the year, a whopping 444.6 per cent annual increase. Revenues for the period reached $685.3 million, up a healthy 57.1 per cent. The results are reported under Generally Accepted Accounting Standards (GAAP).

The brokerage booked post-tax distributable earnings – a metric representing the total sum distributable to shareholders – of $72.9 million, a 30.2 percent increase on the year, as well as earnings before interest, tax, depreciation and amortization (EBITDA) of $168 mln, up 55.9 per cent on the year. The increase in distributable earnings per share was 11.8 per cent, to $0.19 apiece.

Forex Drives Double-Digit Growth

In a press release by the company, BGC’s Chief Executive Officer (CEO) and Chairman Howard W. Lutnick attributed the strong results to the performance of its electronic comprehensive FX brokerage FENICS, which posted double-digit growth, and to the results from its real estate business, Newmark Grubb Frank. Another factor in the successful equation was the integration of GFI Group, which the broker acquired in February.

“e-businesses increased their revenues by more than 142% despite a stronger dollar”

Lutnick added, “These e-businesses increased their revenues by more than 142 percent and their pre-tax distributable earnings by over 82 percent. BGC’s record results came despite the stronger U.S. dollar reducing our Financial Services revenues by more than $24 million during the third quarter of 2015.”

Company president Shaun D. Lynn said, “FENICS continued to have strong momentum in the fourth quarter, as revenues for these high margin offerings more than doubled year-on-year for the first 17 trading days of October, 2015.”

Looking forward and noting the growing drive towards automation, Lynn added the broker expects that “the multi-year trend of our high margin fully electronic products having double-digit percentage growth will continue for the foreseeable future.” For the fourth quarter, the company expects the robust performance to continue, with its main business divisions maintaining double-digit growth.

In its statement, BGC reiterated its plans to sell Trayport, the energy and commodities Trading Platform that it got with the acquisition of GFI, by the end of the year, without providing further details. Trayport’s financial performance is not included in the overall figures for the reporting period.