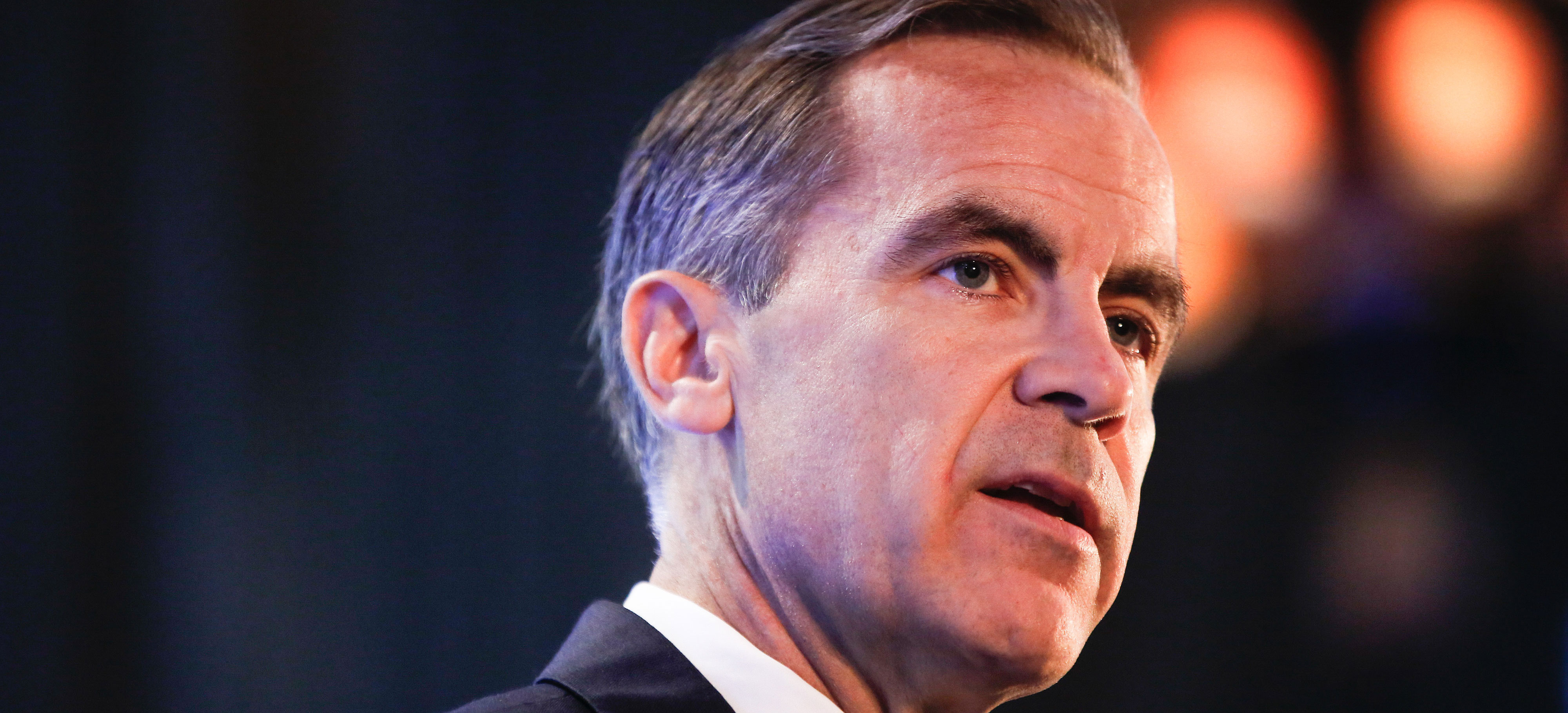

Despite facing renewed criticism, Bank of England governor, Mark Carney is still seen as a source of stability, but with a self-imposed year-end deadline he has bestowed on himself to decide how long he’ll stay at the BOE, that security may soon be rattled.

According to a Reuters report, his choice could have repercussions for the pound which has plummeted 18 percent since the EU referendum and UK government bonds.

The FM London Summit is almost here. Register today!

Uncertainty

Jane Foley, a senior foreign-exchange strategist at Rabobank in London commented, “More uncertainty is not something that would be welcomed. Obviously there’s lots of personal and professional reasons for him to consider, but as far as markets are concerned continuity and communication are going to impact.”

Heralded as the only “adult in the room” by former BOE policy maker David Blanchflower, the governor has been commended as a “bulwark for markets”, reassuring the country the day after the referendum, while cutting the benchmark interest rate for the first time in seven years in August. However, much of his time has also been spent on the defensive, clashing with those who accused him of being too political in the referendum.

Carney has said he’ll decide by the end of the year whether he’ll serve a full eight-year term through 2021, or to leave in 2018 as originally planned when he took the job three years ago.

If he goes with the latter, that would see him leave in mid-2018, about halfway through the two-year EU exit period if Prime Minister Theresa May proceeds with her plan to trigger the process by March 2017.

Bumpy Road for Traders

Traders have had a rough ride of late with a pound flash crash this month seeing the world’s third most actively traded currency pair fall over 6 percent in just two minutes. At about 11 percent, one-month implied Volatility in sterling is the highest among Group-of-10 currencies.

The fallout of the Brexit referendum is also weighing on gilts with investors becoming increasingly bearish thanks to the pound’s weakness, accelerating inflation and lack of clarity on the government’s negotiating stance, while sending 10-year yields to the highest since the vote.