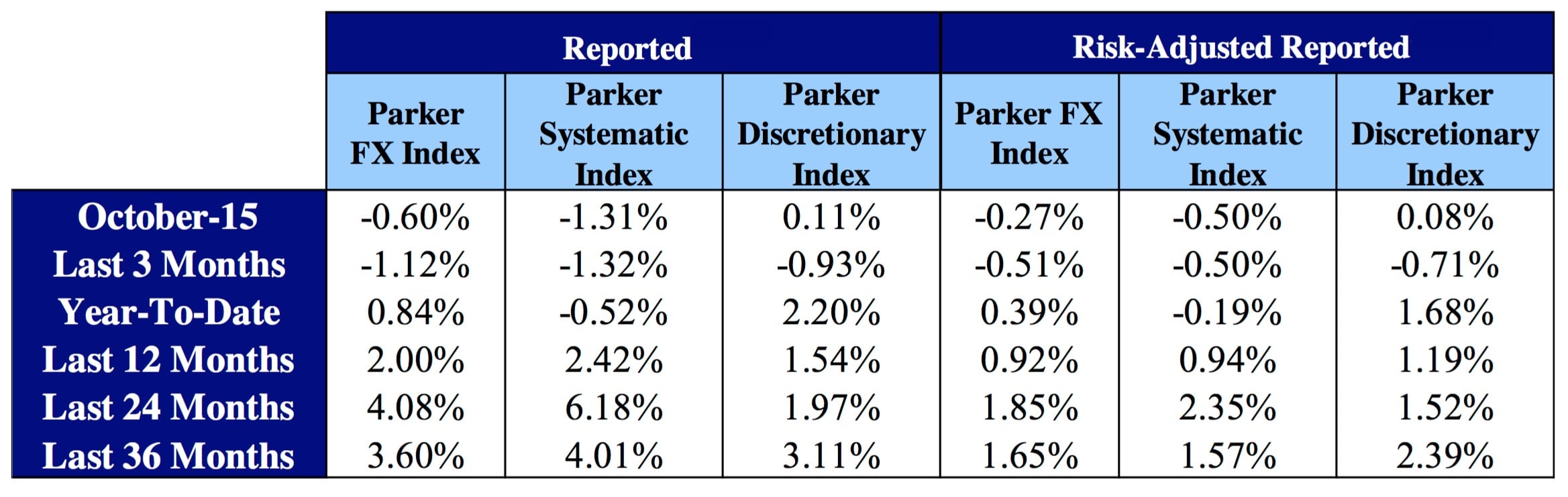

The Parker FX Index, a worldwide benchmark that tracks the performance of leading currency funds, has incurred a decline of -0.6% MoM for the month of October 2015 from September, with only 29% of programs in the index showing positive results.

Parker Global Strategies LLC (PGS) is an alternative investment management group that is proficient in direct investments via Master Limited Partnerships (MLPs). In particular, PGS also acts as an agent of managers for a variety of initiatives involving FX, having erected a suite of investable manager indices for FX.

Last month, the Parker FX Index saw a similar decent of -0.8% MoM during September 2015, with only 26% of the programs in its index showing positive results.

In its latest release in October 2015 however, the index was bogged down in negative territory, yielding results on 28 out of 31 programs, with 19 incurring losses. On a risk-adjusted basis, the Index was down -0.27% in October, while the median return for the month was -0.69%. A closer look at the panel of programs in October 2015 indicated a tighter band of performance with a high of +2.18% and a low of -3.63%.

FX Index Composition

The Parker FX Index also tracks the performance of managers that are derived from positioning both long or shorts of foreign currencies. The Index is equally weighted – as opposed to capitalization weighted – and controls for outliers or swaying in the performance that may not be representative of the currency manager universe.

October saw the continued waffling of the US Federal Reserve, which finally looks to have decided on an interest rate hike in December 2015. Moreover, Chinese stock markets continued to stabilize off of their summer lows, while the US dollar also saw a resurgence vs. the EUR.

At present, the Parker FX Index includes a total of 31 programs managed by 27 firms located across such countries as the United States, Canada, the UK, Germany, Switzerland, Sweden, France, Ireland, Singapore and Australia, whose programs manage nearly $45 billion in currency strategy assets.