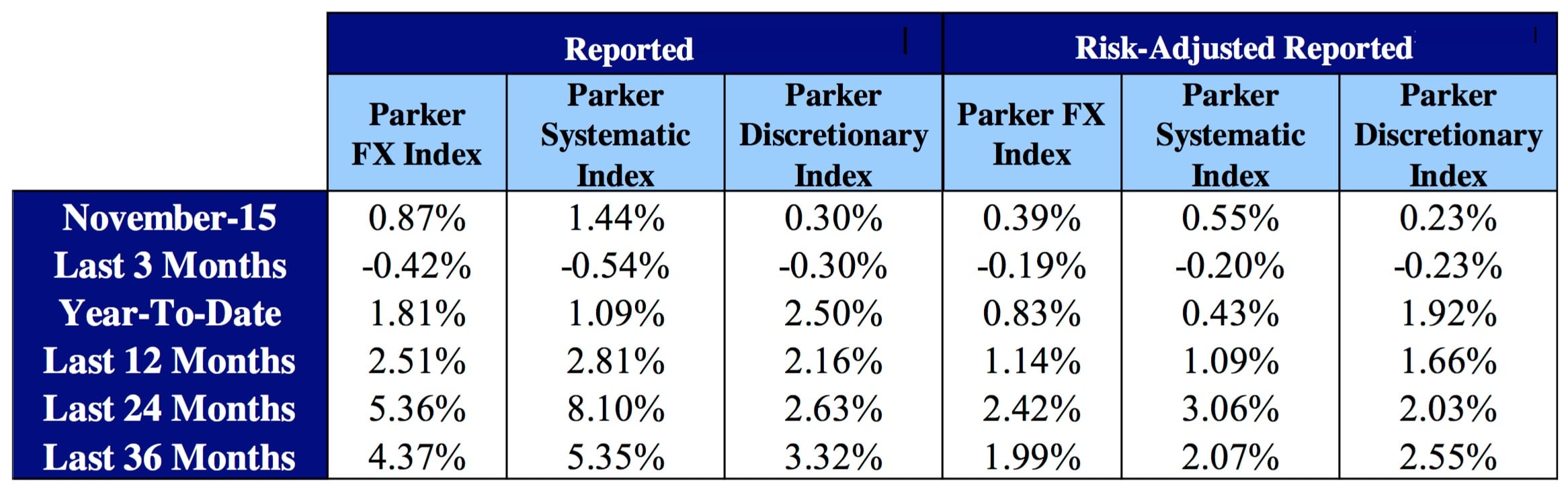

The Parker FX Index, a global benchmark that tracks the performance of leading currency funds, has snapped a downward consolidation in its index performance, rising 0.87% MoM for the month of November 2015 from October, with only 69% of programs in the index showing positive results.

Parker Global Strategies LLC (PGS) is an alternative investment management group that is proficient in direct investments via Master Limited Partnerships (MLPs). In particular, PGS also acts as an agent of managers for a variety of initiatives involving FX, having built a suite of investable manager indices for FX.

Last month, the Parker FX Index reported a monthly loss of -0.6% MoM during October 2015, with only 29% of the programs in its index showing positive results.

In its latest release for November 2015 however, the index managed to enter into positive territory, yielding results on 29 out of 31 programs, with just 9 incurring losses. On a risk-adjusted basis, the Index was up 0.39% in October, while the median return for the month was 0.61%. A closer look at the panel of programs in November 2015 yielded a wider band of performance with a high of +7.03% and a low of -3.16%.

FX Index Composition

The Parker FX Index also tracks the performance of managers that are derived from positioning both longs and shorts of foreign currencies. The Index is equally weighted – as opposed to capitalization weighted – and controls for outliers or sways in performance that may not be representative of the currency manager universe.

At present, the Parker FX Index includes a total of 31 programs managed by 27 firms located across such countries as the United States, Canada, the UK, Germany, Switzerland, Sweden, France, Ireland, Singapore and Australia, with programs managing nearly $45 billion in currency strategy assets.