The landscape of Liquidity providers and Prime of Prime brokerages has experienced dramatic shifts this year ever since the unprecedented action by the Swiss National Bank on January 15, 2015. The crisis highlighted the need for reliability and caused many players to examine the safety of their positions.

London-based Prime of Prime Broker, Sucden Financial, conducted extensive research among brokers, banks, fund managers and professional traders across the globe in order to find out how attitudes and priorities have changed since the SNB aftermath known in the industry as Black Thursday. Finance Magnates received exclusive access to the research's results (based on a survey with 256 responses conducted between May 14 and July 14, 2015) and to insights from Peter Brooks, co-head of e-FX at Sucden Financial, on the current market.

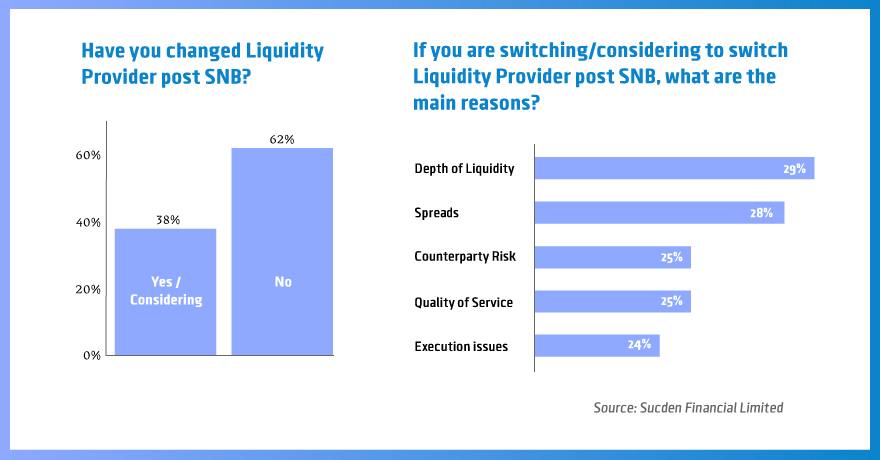

According to the research, post SNB, 38% of brokers, banks and fund managers who responded to the survey have or are considering switching Liquidity Providers (LPs). Brooks says that this confirms the general discussions that have recently been taking place with many firms, highlighting the massive industry adjustment that is taking place.

He further explained: "The first wave of brokers switching LPs was forced upon many as some brokers went out of business and many banks and Prime Brokers started cutting their client base. The PB and Bank cull still continues, but increasingly we have seen clients start to switch providers through their own choice. Sucden Financial has seen an influx of new clients, particularly large brokers, who have traditionally worked with a Prime Broker but now find the terms and requirements on offer to be unfavourable."

Depth and Costs

The number one reason in the survey for a broker having switched LP post-SNB was depth of liquidity, which at first can seem a little surprising. Brooks explained that from talking to clients it seems that post-SNB this factor could also be linked to execution issues, the fifth reason cited for switching LP.

As for his firm, Brooks says Sucden Financial has maintained its banking liquidity relationships and worked hard with the banks to ensure a high quality of execution. "Across Sucden Financial’s entire client base we have seen rejection rates fall from last year’s 1.8% to under 1% this year to date. For some of our largest retail broker clients, rejection rates have been as low as 0.1-0.3% this year."

Spreads have always been a key factor for clients when selecting a Liquidity Provider and continue to be so. In fact, after depth of liquidity, spreads are the main reason why a broker, bank or fund manager would currently seek to switch Liquidity Provider, according to the research.

Peter Brooks, co-head of e-FX at Sucden Financial

There have been many reports about spreads widening post-SNB and there is much discussion in the market to back this up Brooks confirms. "After an initial widening, we have seen spreads at Sucden Financial tighten – and it is no coincidence that we have also seen our business grow," he added.

Interestingly, before SNB events potential new clients seldom asked Brooks for financials and always focused heavily on costs. Post-SNB he says, virtually all potential clients request audited financial information. "Putting safety and security of funds and business partnerships is now just as important as finding the best value LP to work with. This puts us in a very strong position because Sucden Financial is a highly diversified business, with a net worth of over $100 million," Brooks summarized.