Germany's Commmerzbank today reported a steep decline in first-quarter earnings, with volatile markets and low interest rates being blamed for hitting its business with German medium-sized companies particularly hard.

In its quarterly report, the bank said: "Given the increased burden in relation with the ECB's further interest rate cut in March and the highly volatile global capital markets, it has become more ambitious to reach the consolidated profit 2015," echoing remarks made last month by former Commerzbank Chief Executive, Martin Blessing.

Q1 Earnings Hit By Market Volatility and Low Interest Rates

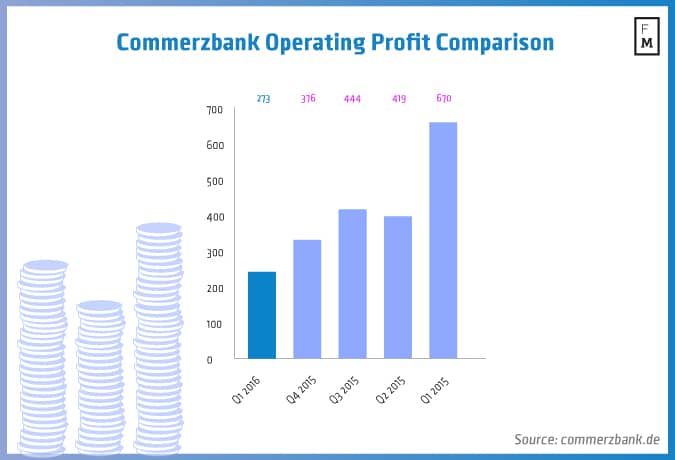

Amid a difficult market environment, Commerzbank generated an operating profit of EUR 273 million ($317) in the first quarter of 2016 against EUR 670 million ($777) in Q1 2015, and a net profit of EUR 163 million ($189) against EUR 338 million ($392) in Q1 2015.

Revenues before loan loss provisions declined to EUR 2,314 million ($2,683) compared with EUR 2,785 million ($3,229) in Q1 2015, reflecting a further deterioration in the interest rate environment and a slowing client activity within difficult markets. Operating expenses in the first quarter were EUR 1,893 million ($2,195) compared with EUR 1,957 million ($2,269) in Q1 2015.

Commenting on the results, Stephan Engels, Chief Financial Officer of Commerzbank said: “In view of difficult market conditions and the increasingly challenging interest rate environment, the Bank achieved a reasonable operating profit in the first quarter. The Bank's risk profile is good and with its CET 1 capital ratio at 12.0 per cent, it continues to hold a solid mid-range position among European peers.”

Commerzbank Acknowledges Involvement in Tax Evasion Scheme

It also emerged today that Commerzbank was one of the main culprits in a widely used tax-evasion scheme that has cost Germany EUR 5 billion ($5.78 billion) in taxes since 2011.

Foreign investors are alleged to have exploited a legal loophole, lending shares to German banks who paid less tax on dividend Payments than the investors would have done themselves in so-called "cum-cum" deals. Commerzbank acknowledged it had been trading in "cum cum" situations, whereby foreign investors, who are obliged to pay taxes of 15 percent on dividends from holdings in German equities, regularly lent their shares to German lenders such as Commerzbank just ahead of the dividend due date, taking them back just days after the payments.

The German banks would receive the dividend payments and incur the taxes, but offset them, for example, with losses carried forward, effectively paying no taxes and benefiting by deducting a fee from the foreign investor before passing on the dividend.