Cornerstone FS Plc (LON:CSFS), a prominent foreign exchange and payments company, has unveiled its final results for the fiscal year ending on December 31, 2022.

The company reported substantial growth in revenue (110%), with an impressive rise to £4.8 million compared to £2.3 million in the previous year. This increase is primarily attributed to a surge in revenue from directly served clients (up 38%), accounting for 78% of the total revenue, amounting to £3.8 million. In contrast, revenue generated through the company’s introducer network constituted 22% of the total revenue, totaling £1.1 million.

"During 2022, Cornerstone continued to deliver on its strategy, improved operationally and achieved a strong financial performance with revenues more than doubling and an increase in gross margin," said James Hickman, Cornerstone's CEO. "This growth was accelerated by two acquisitions during the year, which also supported the completion of our transition to a business that services customers directly."

Revenue Drivers

Revenue was predominantly generated through foreign exchange and payments services, specifically spot and forward transactions, which accounted for 92% and 8% of revenue, respectively. This represents a slight shift compared to the previous year, with spot transactions accounting for 89% and forward transactions for 11% of revenue.

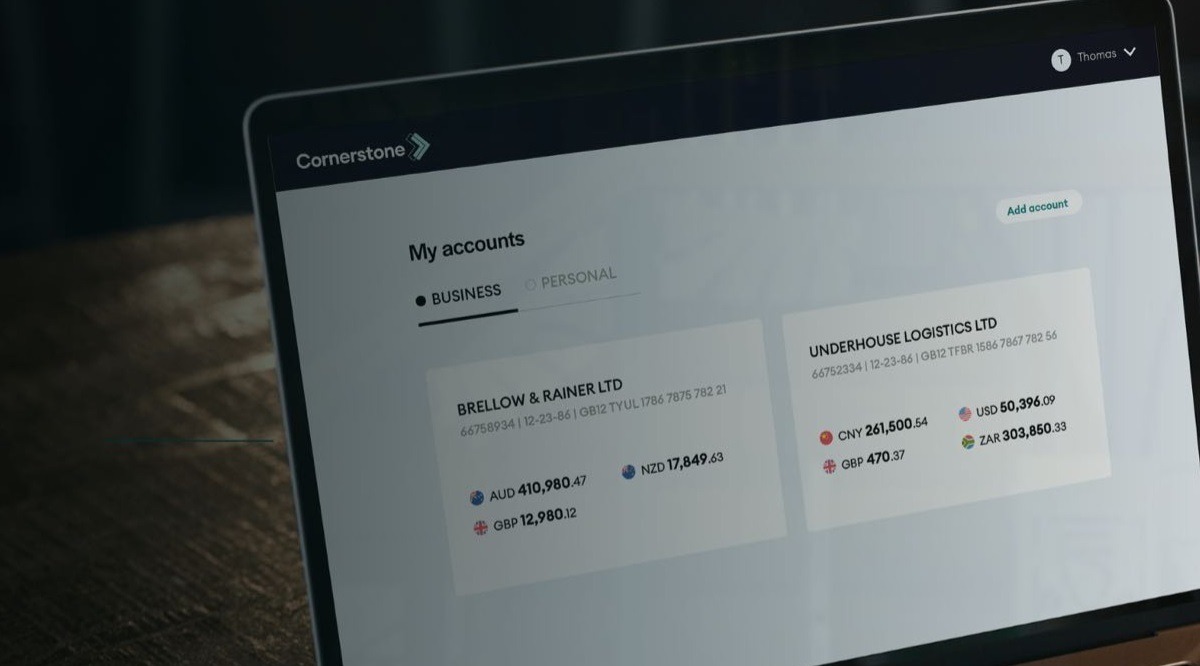

While the majority of transactions were conducted between various combinations of Sterling, Euros, and US Dollars, the company also experienced an increase in the overall number of currency pairs involved, rising from 42 to 58 pairs during the fiscal year.

Both corporate accounts and high-net-worth individuals (HNWIs) contributed to the revenue growth, with a noteworthy expansion in revenue from HNWIs, predominantly driven by the addition of the Asia team. As a result, the proportion of total revenue accounted for by HNWIs went up from 25% in 2021 to 53% in 2022. Throughout the year, the Group also processed payments amounting to £584 million (up from £363 million in 2021).

On the other hand, operating expenses for 2022 amounted to £8.6 million, reflecting an increase from £5.4 million in the previous year. The rise can be primarily attributed to a £1.9 million increase in share-based (non-cash) compensation, reaching £4.3 million, which mainly pertains to share-based incentivization for the Asia team and the General Manager APAC and the Middle East. Additionally, other administrative expenses rose £1.6 million to £4.2 million, partially offset by a £0.3 million decline in transaction costs related to the Company's IPO and acquisition strategy.

Excluding share-based compensation, transaction costs, and depreciation & amortization charges, the adjusted operating expenses, consisting of administrative expenses, improved to 79% of revenue compared to 107% in 2021. Consequently, the Group's adjusted EBITDA loss decreased to £0.9 million from £1.3 million in the previous year.

Cornerstone Optimistic for 2023

The strong trading momentum witnessed in 2022 has carried forward into the current year, with an even greater increase during the first quarter of 2023, resulting in a revenue performance that surpassed expectations. Notably, Cornerstone achieved its first unaudited quarter of being EBITDA positive on an adjusted basis.

Although trading in the second quarter of 2023 has returned to the originally projected growth levels, rather than the exceptionally high levels seen previously, the Group remains on track for a significant revenue increase for the full year of 2023 compared to 2022. The company is optimistic about achieving adjusted EBITDA positivity, as it continues to make progress across its business and leverages the operational and strategic enhancements implemented in late 2022 and throughout 2023.

Cornerstone will continue to expand its partnership network and bolster its offerings. As such, as per the company’s strategic report, the Board maintains confidence in the future outlook and eagerly anticipates reporting on the Group's progress.

"The strong trading momentum experienced in 2022 has been sustained into the current year, and we remain on track for a significant increase in revenue for full year 2023 and are optimistic in terms of adjusted EBITDA positivity," Hickman said. "As a result, and as we continue to broaden our partnership network and offer, we remain confident in the future and look forward to reporting on our progress."