Singapore Exchange (SGX) released the monthly trading volumes for January 2022. Similar to other exchanges notable gains were seen. The trading volumes on SGX rose by +3% month-on-month (m/m) to 20 million contracts (approx.), the largest amount since September 2021.

The volume in Equity index futures reached +7% m/m to 15.1 million contracts with higher activity in SGX FTSE China A50 Index Futures.

In foreign exchange (FX), SGX INR/USD futures' volumes increased +6% m/m to over 1 million contracts in January. India's growth projections went up, which may have also increased Rupee hedging demand. In addition, it is worth highlighting that SGX finalized the acquisition of MaxxTrader, a direct-to-market forex trading platform.

Iron Ore and Securities Turnover

The trading volume of SGX USD/CNH futures declined in January, which is possibly due to the Luna New Year Holiday. Open interest of the contract climbed by +12% m/m, reaching more than US$11 billion.

SGX’s bellwether iron ore derivatives declined in January on lower activity in the physical market. Due to the lockdowns in China, factories' activity was significantly lower, which affected production. Nevertheless, iron ore volumes increased by +11% year-over-year (y/y) to 1.8 million contracts.

In addition, Iron ore volumes were 6% of total trading volumes in commodities. Forward freight agreements (FFA) volumes climbed by +12% m/m to 138,271 contracts.

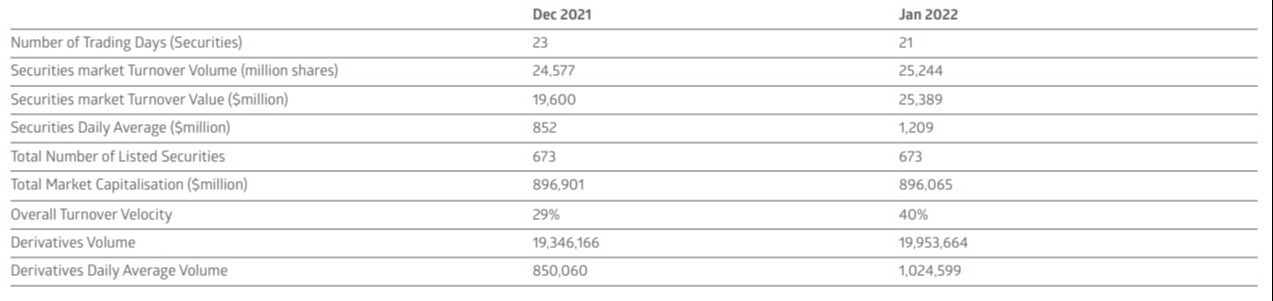

Moreover, the securities market turnover reached S$25.4 billion, a +30% increase m/m. Securities Daily Average Value (SDAV) spiked by +42% m/m to $1.2 billion. The net institutional buying of Singapore stocks reached S$800 million with S$200 million in net selling in December.

source: SGX

The exchange-traded funds (ETF) on SGX jumped by +42% m/m to S$453 million. Structured warrants and daily leverage certificates (DLC) saw a moderate rise of +22% m/m to S$437 million.

Furthermore, SGX new bond listings (121) gained +59% m/m in January, reaching S$44.5 billion.