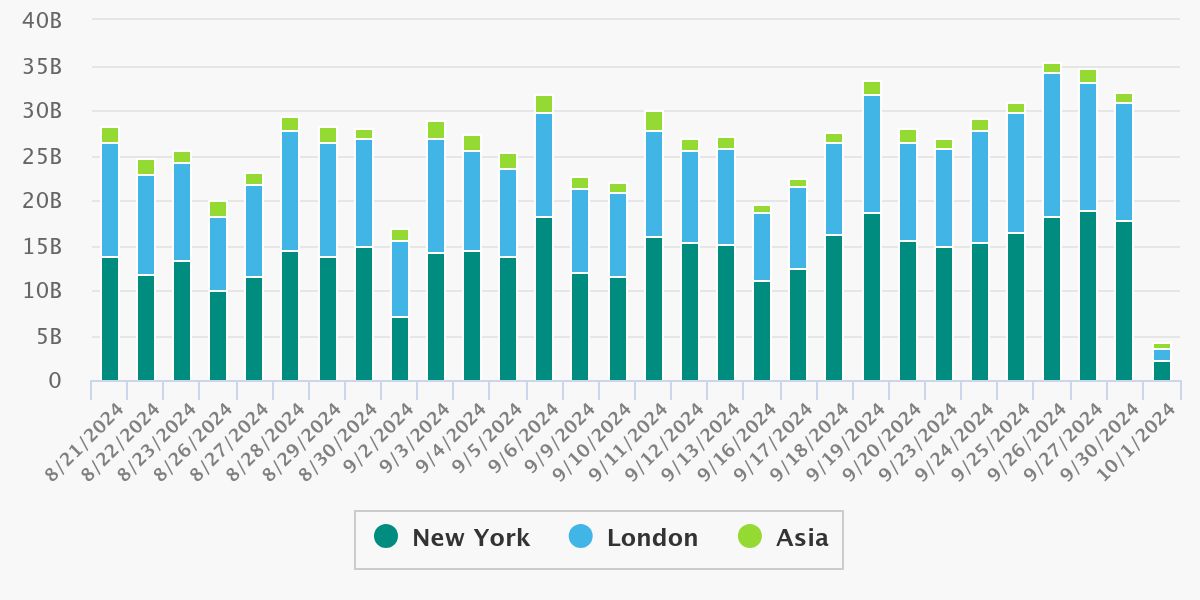

After two months of significant volatility in the foreign exchange (FX) market, September brought a noticeable slowdown. The dollar tested over one-year lows, and institutional investor activity decreased across all markets from Tokyo to Chicago.

Institutional Spot FX Volumes Declined in September 2024

Click 365, responsible for FX futures trading on the Tokyo Financial Exchange (TFX), recorded a sharp drop in trading volumes of over 33% to 1.9 million contracts. The average daily volume (ADV) shrank to 92,300 compared to 131,900 reported a month earlier. Year-over-year, volumes saw a modest increase of 1.1%.

The highest activity, as in previous months, was observed in futures for the USD/JPY currency pair. Here, the ADV contracted to 36,900 contracts, down 17%. However, on an annual basis, the indicator rebounded by almost 13%.

A decline in volumes in September was also noted in the United States, where Cboe spot volumes fell below $1 trillion to $980.7 billion. Although last month had fewer trading days than August (21 vs. 22), the ADV still shrank from $49.9 billion to $46.7 billion.

The entire third quarter managed to close with better results: total volume reached $3.1 trillion over 66 trading days, compared to $3 trillion in Q2. Compared to the previous year, there was a significant jump from $2.8 trillion reported in Q3 2023.

Europe Also See Declines

On the German stock exchange -owned 360T, volumes also contracted in September, with their total value falling from $682 billion to just under $661 billion. However, ADV grew modestly, reaching $31.5 billion, compared to $31 billion reported in August.

As for Euronext FX's Fastmatch, the situation unfortunately aligned with the broader market trend. Total volume reached $579 billion, down from $638 billion the previous month. ADV returned to $28 billion, similar to July, after rebounding to $29 billion in August.

The silver lining is that for all four trading centers mentioned above, year-over-year results were better. For example, Euronext FX reported a volume of $503 billion for September 2023, while 360T reported $585.8 billion.