According to filings with the US Commodity Futures Trading Commission (CFTC), US-based Seed CX (short for Seed Commodities eXchange) has filed an application to become a Swap Execution Facility (SEF) under the name Seed SEF LLC where it aims to act as an institutional trading platform for hemp-related commodity derivatives contracts, among other tradable instruments.

The filings – accepted early February and still pending by the CFTC - were signed by the company’s president Brian Liston whose background includes investigating market efficiency of Asian exchanges and optimal portfolio construction techniques for risky assets, and who achieved an impressive 5.0 GPA from Massachusetts Institute of Technology (MIT) in his Master of Finance under the guidance of former CFTC Chief Economist Andrei Kirilenko, according to information on his company website.

Seed CX’s site describes that there are idiosyncratic risks in unique underserved markets (such as hemp), and how its goal is to use financial engineering tools to create financial security in such marketplaces.

The expected financial trading products include weather derivatives and industrial hemp swaps, options and forwards, and which the company aims to transact after regulatory approval.

Backers and leadership: consortium of investors and GMEX stake

Regarding Mr. Liston’s background, it appears he has probably the best set of credentials you could look for in someone tasked with leading an effort like this. Seed CX is aiming to “become the first trading platform for hemp” (as it retweeted from one of its followers ), and along with the other nine people on the SeedCX team including the two co-founders.

Exciting news! If it gets regulatory approval, #KYHIAMember @SeedCX will be the first trading platform for #hemp! https://t.co/CIr5obSn0y

— KYHIA (@KentuckyHIA) February 17, 2016

The Seed CX platform technology is powered by GMEX Technologies based in the UK. Finance Magnates obtained comments from their group CEO regarding the news – including about their 20% stake - as part of the deal to support Seed CX, as described in detail further below.

A Fortune magazine article highlighted the first round of funding that Seed CX secured for $3.42 million as a convertible note, announced yesterday, and how while many of the 50 investors backing the effort had not made their names public yet, several did take the spotlight including individuals from Struck Capital, 500 Startups, iAngels, Charlie O’Donnell from Brooklyn Bridge Ventures, Ron Geffner, David Adler, Christopher Lee, Darren Herman, Tom Sosnoff, and Julien Codorniou.

Seed CX co-founder and CEO Edward Woodford told Fortune: “The perception of cannabis - sometimes it widens peoples’ eyes and sometimes it narrows them,” and added, “In Silicon Valley, it is a real turnoff.”

Hemp market could also attract scalpers and speculators

However, traders may not be so turned off and may find ample opportunity in hemp trading – as with Bitcoin or any newly emerging illiquid market, inefficiencies abound, and initially exploiting such price anomalies or Liquidity squeezes tends to help improve future price and market improvements as subsequent mechanisms are developed to optimize the pricing and trading infrastructure from such re-occurrences. This cyclical process makes markets correct themselves as they grow, while minimizing the chance for future price discrepancies.

Moreover, the driving purpose behind the establishment of a futures or derivatives market is to transfer risk away from hedgers to speculators, or for speculators to be able to take the risks that hedgers (suppliers and users) are looking to avoid (for example, when a speculator is on the other side of a trade with a hedger, where the hedger has no risk on the trade because they own the underlying as well – whereas the speculator has a naked position and has risk).

Mr. Woodford said in a company statement regarding the news: “We are excited to have developed the world’s first industrial hemp derivative. We have worked closely with hemp farmers and processors throughout the US, who want access to important hedging tools to protect this growing agricultural commodity.”

Before paving the way for hemp, at least initially, in its filing with the CFTC as an SEF, in response to Core Principle 3 regarding “swaps not readily susceptible to manipulation”, SEED SEF provided the example how a singled legged fixed or floating weather swap that is cash settled based on the San Joaquin Valley Water Supply Index (WSI) which is designed to measure water flows at 8 key intersection points in the river system and is published by the California Department of Water Resources (WSI Swap), proposed to meet Core principle 3, according to the regulatory filing. The ability for an SEF to have a central limit order book and related mechanisms provides potential advantages structurally.

Trading technology for hemp derivatives and Seed CX effort

The Fortune article cited a number of trading platforms that provided commitments to support the Seed CX effort, including GMEX Technologies (mentioned above), that also released a press release regarding the news, and which is providing platform technology related services to Seed CX in return for a 20% option stake and a board (observer) position.

The deal with SEED was aligned to options and cash flow

GMEX Group CEO Hirander Misra

Finance Magnates obtained further insight regarding how the commercial terms of the partnership was structured, and GMEX Group CEO Hirander Misra explained to us via email: “The options vest in 3 tranches with a third already vested in signing, and the other two tranches based on milestones during the course of this year. Once vested they can be exercised at any time. GMEX Group as part of its holistic exchange technology and business services model follows a partnership approach as opposed to a standard customer-supplier approach to align interests with its exchange partner and would rather focus on a small number of high quality exchange deals with potential where the commercial model can be a mixture of cash Payments in addition to equity or options and/or revenue share. The deal with SEED was aligned to options and cash flow.”

GMEX Group’s stakeholders include Deutsche Börse AG, Société Générale Corporate & Investment Banking and Forum Trading Holdings Limited, as per their website description.

Mr. Misra added in response to questions posed by our reporters about its background with the needs of an SEF: “This is the first SEF that GMEX has provided services for but this is not a great departure in terms of the fully functioning exchange front end (ForumTader), APIs, matching engine (ForumMatch), surveillance platform (ForumMatch) and reports (ForumReports) (all of which were the needs of SEED and are being provided to them), which GMEX runs for its own interest rate swap futures market in London based on underlying SEF and MTF data as well as auction, central limit order book and quote driven models for other exchanges.”

Hemp and cannabis in the media, differentiating between them

There is cannabis, and then there is hemp, but aren’t they the same thing? Hemp is any cannabis plant that contains less than 0.3% tetrahydrocannabinol (THC) on a dry-weight basis. The 2014 farm act in the US federally legalized the cultivation of hemp in states where the legislature allows it to be grown. While hemp may be legal everywhere, growing it is not. In Colorado, for example, both hemp and cannabis are big business already. Seed CX would need to focus on nearly 28 states where farmers or suppliers could participate in the market.

As far as meeting the hemp definition, the application and use of hemp can become widespread and a useful and valuable commodity across numerous industries, including for farmers, end-users, because of the plant's strong ability to capture carbon. It has already surpassed the billion dollar mark after its first year of legalized cultivation, according to a 2015 US congressional research report referenced by Seed CX.

The additional uses of the plant - beyond what is normally associated with this commodity- have been largely underserved and are the apparent focus of the Seed CX effort.

Related products: from taboo to new normal

The already huge wave of interest and media attention on cannabis in recent years – almost entirely related to the THC and nearly 85 other cannabinoids found in the plant – focused on the expected medical benefits and recreational use, with some governments and societies changing their positions on this often controversial subject and with many new laws proposed and enacted already in different parts of the world regarding the plant's legal status and usage.

In most other parts of the world both cultivation and use are illegal or restricted. Nonetheless, the landscape for cannabis has been increasingly changing, and putting all cannabinoids (and jokes) aside, the plant itself has a vast number of uses not related to its psychoactive ingredients, and remains a potential game changer for a number of key industries, including as a financial markets product.

Potential for hemp market: in its first year of legal cultivation over $1.5 billion

There are already a number of legal cannabis/hemp related public companies (and securities) that are traded on the US financial markets, and thus provide investors the ability to speculate - albeit indirectly - on the commodity; therefore it seems plausible as a derivative or any other financial instrument too, or at least initially the hemp side of the spectrum that Seed CX is spearheading. The prospects for the industrial hemp industry seem to be improving across several mediums- this could help further pave the way.

Initially, after approval, Seed CX plans to target its offering through its SEF, and offering a cash-settled contact. Mr. Mishra explained to Finance Magnates regarding the target market focus: “The target is the whole liquidity supply chain to run as an institutional market much like any other SEF in terms of client potential with the added advantages of the commodity supply chain related to the products.”

“In terms of liquidity there will be a liquidity provision scheme to ensure the right market makers are onboard as well as work to then ensure the is the right form of natural liquidity to interact with this,” he concluded.

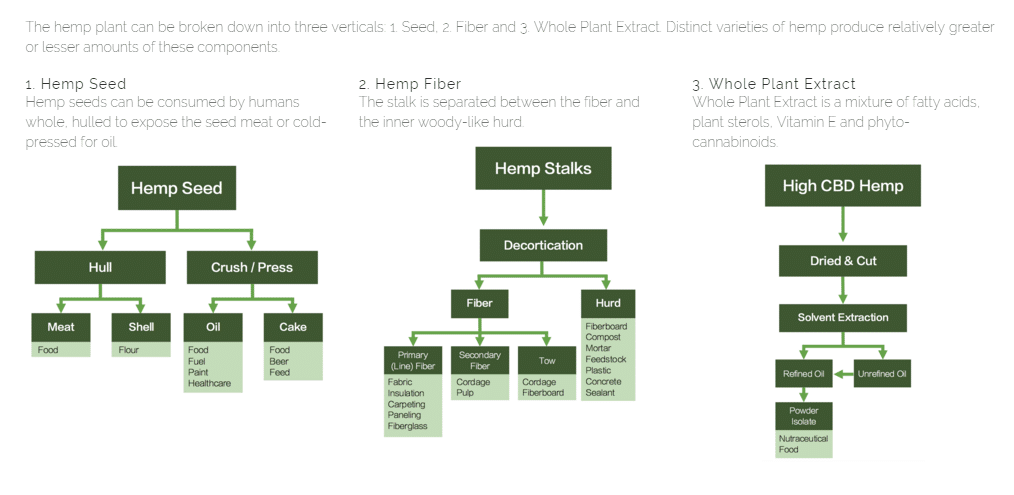

Hemp Parts Diagram

Source: Seedcx.com