The Sydney-based Exchange operator ASX Group, known by its main marketplace business, the Australian Securities Exchange (ASX), today announced its monthly group activity report for April 2016 showing increases in the amount of total capital raised which reached $9.4 billion for the month, higher by 114% when compared to the prior corresponding period, according to the company’s official press release.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

The exchange operator showed that it fared well as the value of ASX-listed stocks rose 3.2% during April, when compared to the performance of some regional peers across Asia-Pacific, as well as when compared to major European indices in the UK and Germany during the month.

ADV up yet total value dips

ASX reported that its average daily number of trades in April were 30% higher when compared to the same month last year, yet average daily value traded on-market was lower by 2% over the same period, reaching $3.9 billion, indicating that a larger number of smaller transactions led to the overall lower total value during the month.

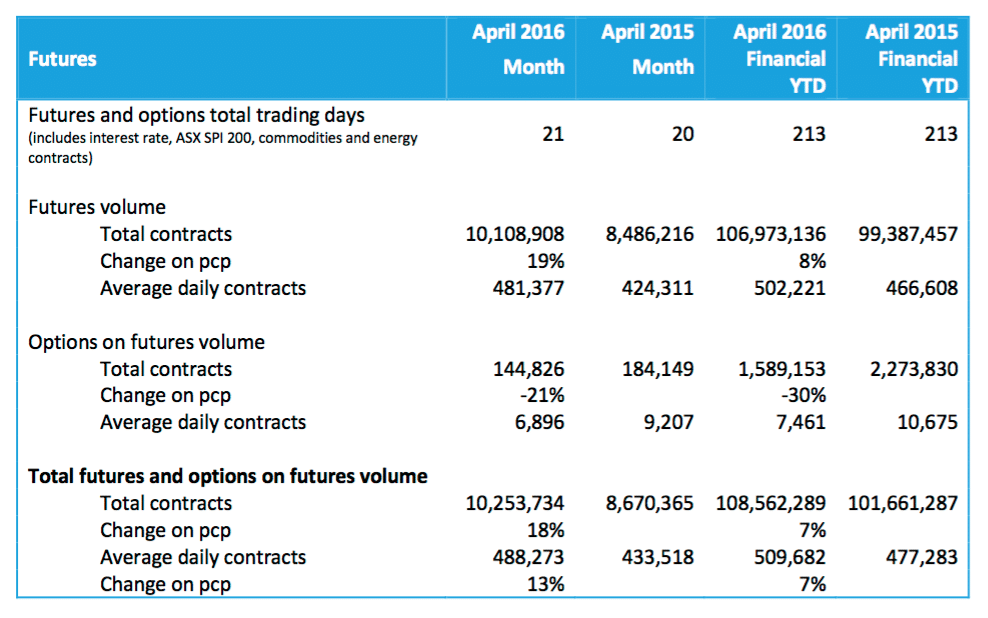

Finance Magnates previously covered ASX's March statistics, which were worse than April's figures when comparing the amount of capital raised, among other figures including the on-market metrics. An excerpt below from the ASX press release today shows how futures related trading fared during the period.

Source: ASX Group April 2016 report

New listings in April

There were 10 newly listed companies added during April, up from 5 year-over-year, which brought the total year-to-date to 103 added so far in 2016 to combine for a total 2205 currently listed companies as of the end of last month.

This total is down slightly from the 2212 listed companies that were reported during the same time last year, as firms compete to remain listed after initially becoming public - some of them cannot subsequently meet the reporting and listing standards and may become de-listed.

The amount of initial capital raised was over $4.5 billion, and secondary capital raised was over $4.8 billion, and together they made up the nearly $9.4 billion which was higher by 119% when compared year-over-year. In addition, the year-to-date total capital raised for 2016 was just over $72.3 billion at the end of April, higher by 33% compared to the first four months of 2015.

The news follows after the company's CEO recently stepped down, and as ASX is looking at the use of blockchain related technologies to help its exchange and clearing operations.

ASIC Sandbox update

In similar news, the Australian Securities and Investment Commission (ASIC) announced earlier today that it is looking at issuing a consultation paper for its regulatory sandbox that was launched nearly a year ago to help companies including fintech firms test out their related products. The paper will detail how ASIC will go about assessing how different firms may qualify for various exemptions or licenses. This includes the six-month window that firms can get for testing out their products without a license, as the regulator aims to help support innovation while helping startups familiarize themselves with the related rules.

ASIC Commissioner John Price said in the Commissions' press release today: “ASIC anticipates that the proposed regulatory sandbox exemption may bring better financial services to market quicker while being mindful of consumer protection concerns.”

"ASIC will continue to prioritise assistance to fintech start-ups to promote market efficiencies and benefits for consumers and investors. We will build on our first year’s Innovation Hub experience with a variety of initiatives," he added.