Avelacom, a technology infrastructure provider to the financial markets, announced on Wednesday the launch of a backup connectivity route between Chicago and Tokyo.

This development came ahead of the United States elections when the market is expected to swing significantly, thus increasing the trading infrastructure demand from banks, exchanges, and trading firms.

Financial markets around the globe saw extreme volatility earlier this year due to the impact of Coronavirus on the economies. Now with the US Presidential election scheduled for November 3, market Volatility is expected again.

“Financial markets can be extremely vulnerable during periods of high volatility, and firms need to be able to rely on their infrastructure and backup systems to sustain high performance,” Avelacom CEO, Aleksey Larichev said.

A Backup Route with 5 Milliseconds Latency

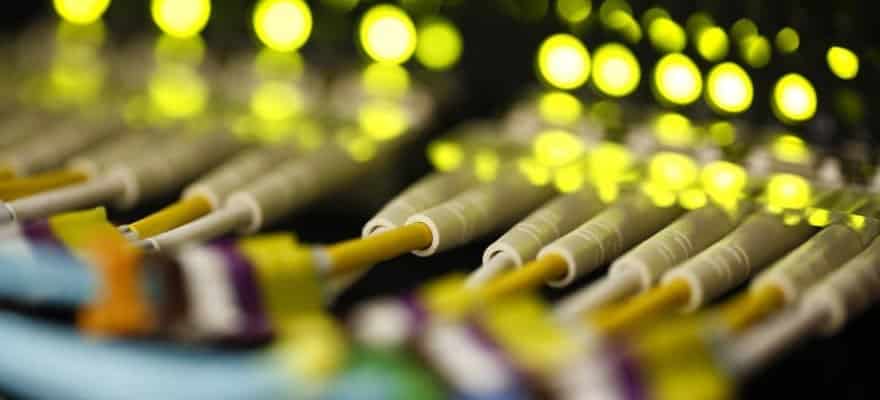

The press release shared with Finance Magnates detailed that the new backup route is geographically diverse from the PC-1 submarine cable system used for most primary routes. It has a 5-millisecond difference in latency compared to the primary connection connecting the two cities, making the backup the fastest non-PC-1 route.

The Chicago-Tokyo route is also strategically chosen as this will see bursts of volatility, the company detailed. The backup route will be additionally used to connect the United States with other Asian financial hubs, including Hong Kong, Shanghai, Singapore, Taipei, and Thailand.

Earlier this year, the company formed a new connectivity route between New York and Sao Paulo, offering the fastest data transmission lines between the two continents.

“Avelacom is setting the standard for back-up routes to prevent outages and losses as a result of hardware failure or a severed cable. By proactively optimizing the trans-Pacific and North American terrestrial fiber routes, Avelacom provides fully protected network solutions to support a robust trading environment for latency-sensitive financial institutions: banks, prop shops, hedge funds, brokerage firms,” Larichev added.