Bats Global Markets, Inc. (Bats) has altered its incentive schemes for Market Makers , namely those who play an integral role in the life cycle of exchange-traded-products (ETPs), per a company statement.

Take the lead from today’s leaders. FM London Summit, 14-15 November, 2016. Register here!

Bats has opted to create a more favorable environment for market makers via the launch of a reward program, which builds on an existing Issuer Incentive Program for all ETPs. In particular, the new iteration of its payment program helps allow a given issuer to capture benefits from listing on Bats.

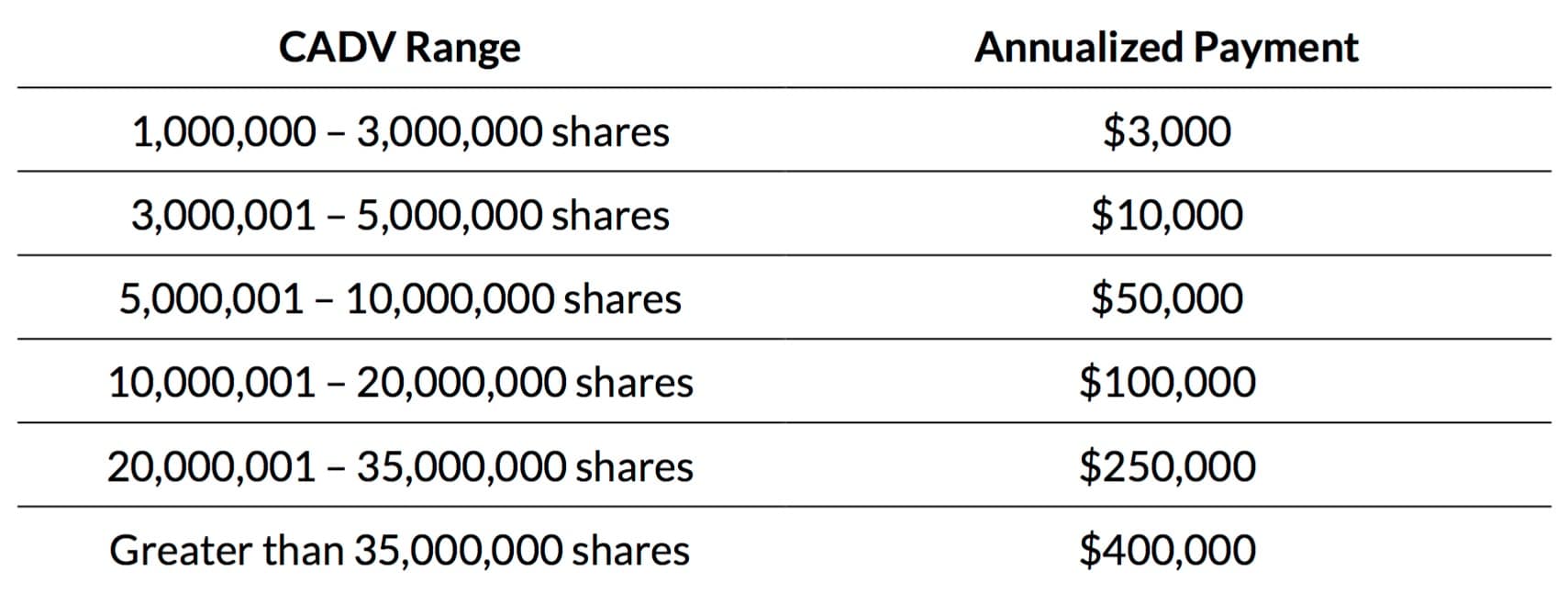

As such, market markers can earn a potential annual incentive payment of up to $400,000 to each fund with a Consolidated Average Daily Volume (CADV) of over 1 million shares per day. This push was reinforced by rebates to Lead Market Makers (LMMs) for select products, following consultation with key ETP industry participants. The final result of the initiative will be the unveiling of the Lead Market Maker Partnership Program, which is slated to come into effect on September 1, 2016.

Multi-Tiered Rebates

The CADV ranges per-product will reflect the level of rebate available to LMMs, which can be derived from the following table:

According to Laura Morrison, Senior Vice President (SVP) and Global Head of Exchange Traded Products at Bats, in a recent statement on the program: “We are committed to helping our issuers grow the assets under management and Liquidity of their listed products, and separately, ensure that liquidity provision is sustainable throughout an ETP’s lifecycle.”

Laura Morrison

“By further incentivizing market makers, through the most competitive ETP incentive scheme available globally, they will be able to provide deeper and more resilient liquidity to all their assigned products,” she added.

“Our pioneering, nimble nature allows us to experiment and adjust where necessary to best suit the markets and participants we serve. In this instance, the excellent dialogue we have with ETP industry participants, and in particular, our fast-growing and very diverse family of issuers and market-makers, has led us to make this change to our incentive schemes,” explained Bryan Harkins, Executive Vice President (EVP) and Head of U.S. Markets at Bats in an accompanying statement.