The Chicago Board Options Exchange (CBOE), C2 Options Exchange, and CBOE Futures Exchange (CFE), part of the CBOE Holdings Inc group structure, today reported May trading results which notched higher from the previous month and helped reverse April's downtrend from March across the three venues.

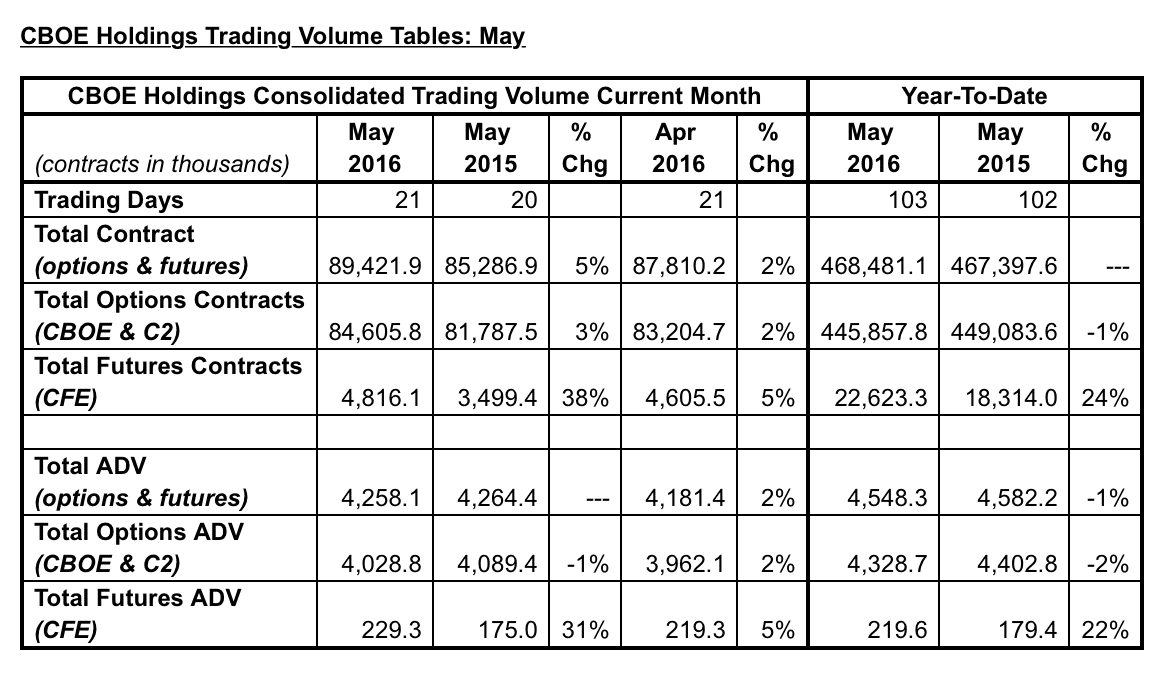

The total number of options and futures contracts traded across CBOE, C2 and CFE totaled 89.42 million in May, up by 2% from 87.81 million reported by CBOE Holdings in April, yet was unchanged from May 2015.

The ADV for this overall total was 4.25 million contracts per day and also reflected a 2% rise from 4.18 million contracts in April, as both months had 21 trading days for the ADV to be calculated from the monthly total.

CBOE & C2 Up 2%

Total options contracts from CBOE and C2 reached 84.6 million contracts in May and also higher by 2% up from 83.2 million in the prior month and little-changed on a year-over-year (YoY) basis. The ADV for these contracts reached 4.02 million in May, up by 2% from 3.96 million in April.

The total number of futures contracts traded on CFE in May was 4.81 million, higher by 5% from 4.6 million month-over-month and up 25% YoY. The ADV from this venue's contracts was over 229,000, up by 5% from over 219,000 in the prior month and higher by 31% YoY.

CFE Futures up 5%

The popular index option contract, SPX, which tracks the S&P 500 index, experienced the most activity at CBOE in May and recorded an ADV of 899,006 contracts, higher by 13% year-over-year.

CBOE Holdings had announced in May that it made a minority equity investment in the US-based swap futures exchange group Eris Exchange Holdings, LLC. An excerpt of the trading volumes for May can be seen in the table below which accompanied the CBOE Holdings statement.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

source: CBOE May 2016