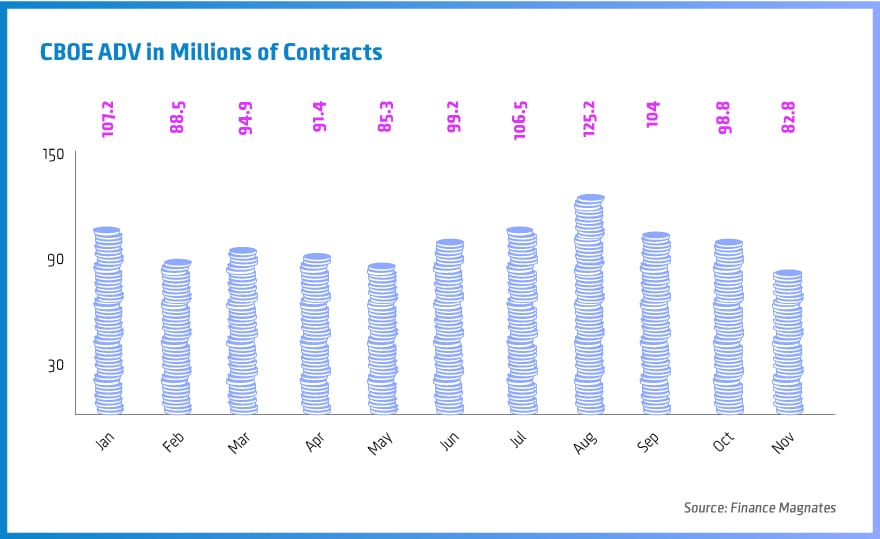

The Chicago Board Options Exchange (CBOE) Holdings (NASDAQ: CBOE), a paramount operator of the US equity options market, has reported its volumes for the month ending November 2015, according to a CBOE statement.

During November 2015, CBOE Holdings reported a total trading volume for options contracts on Chicago Board Options Exchange, C2 Options Exchange, and futures contracts on CBOE Futures Exchange of 82.8 million, plunging lower by -16.2% MoM from 98.8 million contracts in October 2015.

The recent downtrodden figures were also lower over a yearly timeframe, with November 2015’s volumes at the CBOE marking a decrease of -3.5% YoY from 85.5 million contracts in November 2014.

In addition, total options and futures average daily volume (ADV) at CBOE Holdings during November 2015 yielded just 4.1 million contracts, relating to a decrease of -8.9% MoM from 4.5 million contracts in October 2015 and a drop of -8.9% from 4.5 million in November 2014.

CBOE Volumes

Across its options business, Chicago Board Options Exchange ADV came in at 3.7 million contracts in November 2015, down -7.5% MoM from 4.0 million contracts in October 2015, coupled with a dive of -9.8% YoY from November 2014. The exchange-wide trading volume totaled 74.2 million contracts in November 2015, grinding lower by -16.4% MoM from 88.8 million contracts in October 2015.

In terms of ADV, index options in November 2015 incurred a fall of -15.0% MoM from October 2015, while ADV in exchange-traded product (ETP) options also fell the same margin – equity options also plunged by -14.0% MoM from October 2014.

C2 Option Exchange

Furthermore, C2 Option Exchange’s November 2015 trading volume totaled 5.1 million contracts, down -15.0% MoM from 6.0 million contracts in October 2015 and a move lower of -14.0% YoY from November 2014. Meanwhile, ADV was reported at 253,222 contracts in November 2015, a -7.6% MoM decrease from 274,198 contracts in October 2015 and a -18.0% drop YoY from 308,400 contracts in November 2014.

VIX Futures

Finally, CBOE Futures Exchange released a November 2015 ADV in VIX futures of 173,790 contracts, constituting a -4.0% drop from 181,562 contracts in October 2015 and 24.0% uptick YoY from November 2014. Additionally, total volume in VIX futures for November 2015 was 3.5 million contracts, down -13.0% MoM from 4.0 million contracts in October 2015 and up 30.0% from 2.7 million contracts in November 2014.

Yesterday, CBOE revealed that it would be launching a suite of new options for two FTE Russell indices – the FTSE 100 and the FTSE China 50 – to help provide investors with access to the most liquid markets segments in the UK and China. The new options are based on mini versions of the FTSE 100 index, comprised of 100 blue-chip companies in the UK, and the FTSE China 50, which includes the country’s largest companies listed on the Stock Exchange of Hong Kong.