Following a conference that the Chicago Board of Options Exchange (CBOE) held today in Florida, the company's Chief Operating Officer (COO) Edward Provost announced plans for new FLEX index options to be launched with Asian and Cliquet style settlement and plans for the products to go live on March 21st at the Chicago-based exchange.

The news came during a Risk Management Conference (RMC) that the CBOE held today, followed by a press release. The new products are expected to draw interest from insurers who use similar contracts in the OTC markets and who will soon be able to trade the same type of options on-exchange at the CBOE.

Flex index options are a product line the CBOE invented a long time ago, and it still remains viable. This is where the two new options will be launched under the FLEX product suite, including customizations of certain contract specifications that allow traders to select for example the strike price, exercise style and expiration date, among other variables that are typically fixed in more plain vanilla style options.

"Transacting on an exchange may provide insurance companies with improved execution prices on their hedges, while simultaneously reducing counterparty risk."

Contracts Aimed at Hedgers

The CBOE mentioned how it expects insurance companies to use these contracts as an alternative to the OTC options that insurers use for hedging their annuity issued products, for example. This includes where similar Asian and Cliquet style settlements are sought by insurers for hedging index-linked annuities.

"CBOE is pleased to offer indexed annuity writers with new options-based hedging alternatives," said CBOE's COO Edward Provost regarding the launch. "Transacting on an exchange may provide insurance companies with improved execution prices on their hedges, while simultaneously reducing counterparty risk," he added

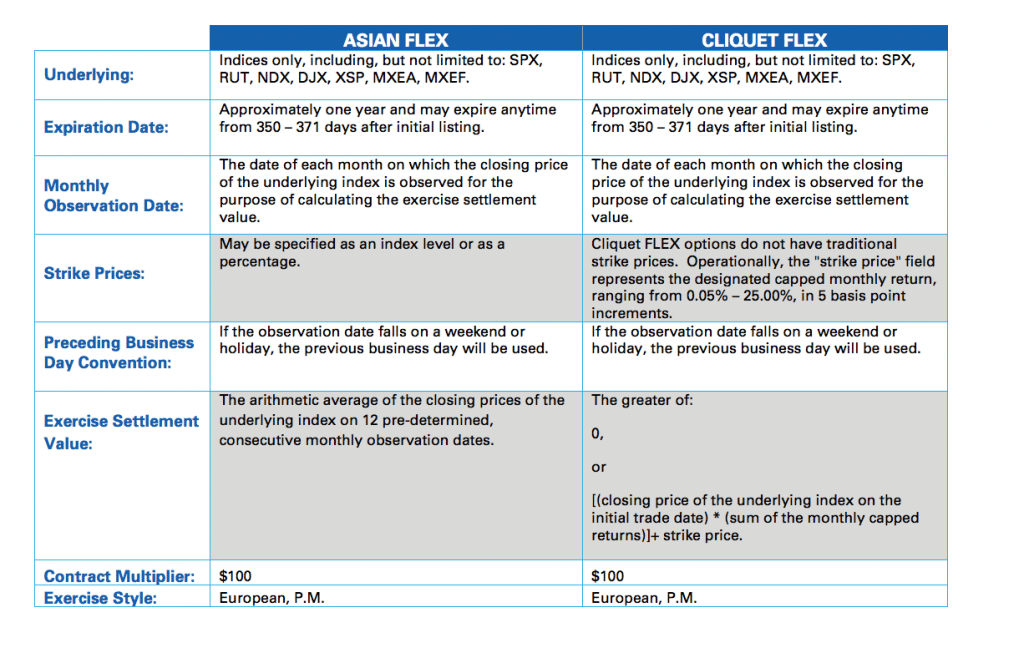

An example comparison of the contract specification features across the expected product launches can be seen here below, excerpted from the CBOE product guide:

source: CBOE

Both contract styles are for 12 month terms with monthly observations, with the settlement value determined differently for each contract. The Asian options take the options average underlying closing price through the life of the contract to determine its settlement value, instead of the single underlying price at expiry (such as is used for European style exercises which can only be exercised on the expiration date using the final closing price). However, both contracts will use a European P.M exercise style, yet with their respective difference in how the settlement value is calculated.

Finally, the Cliquet option, also known as a ratchet option, is more complex and is a series of at-the-money (strike price = to underlying) forward-start options where the total premium is determined in advance (i.e versus a dynamically changing premium based on underlying price and changes in the ratio of implied vs historical Volatility ). This product is expected to be a specific type of Cliquet option known as the monthly sum cap.

New Options for Institutional Traders

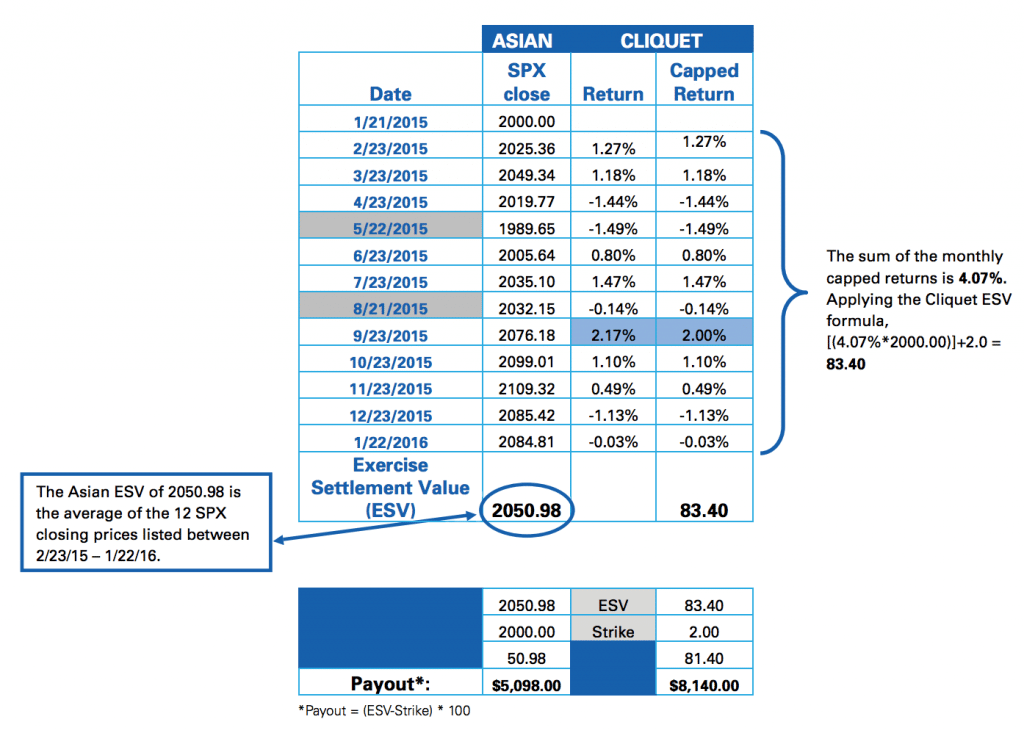

An example was given in one of the product guides, which noted how the description provided will be the subject of a rule filing to be made with the SEC subject to possible revision and regulatory approval, disclosing potential changes to come. Here is an excerpt of one of the tables in the guide:

Source: CBOE

The monthly sum cap contract will have a global floor where the option holder receives the greater of zero or the sum of monthly capped returns. Expectations are that the new FLEX options will provide insurers with an alternative hedging method in an exchange-traded environment where transparency, price discovery, and centralized clearing are attractive differentiators.

Both contracts could also attract speculators and other risk hedgers, including as part of a different approach to options trading strategies, including the many various strategies available using traditional options contracts, such as on the SPX - which is cash-settled as there are no underlying shares in the index (versus options on the SPY which is an ETF that tracks the same underlying). However, according to people close to the developments, the new products are mainly geared towards the hedging needs of insurers, and any retail volume is likely to be negligible as the product offering is also determined by brokerages needs and related permissions offered to clients (i.e. level 1 or level 2 options trading, etc..) based on their needs and experience.

Either way, in an index like the S&P500, there is a lot of money tied-up in the options markets - such as in SPX contracts on the CBOE. Any new product for that index and the others listed in the example above including RUT, DJX, NDX among other major indexes, could attract interest from institutional traders, and market maker's on the CBOE floor, in addition to the targeted insurance companies. For now the initial focus is towards that latter group, as the CBOE eyes to acquire the OTC market share from insurers and shift their volumes on-exchange instead - the aim of the new launch. The news follows the company's recent share repurchase, and after its investment in VEST.