The widely diversified operator of derivatives marketplaces, the CME Group, has today announced that December 2013 volume averaged 10.9 million contracts per day, up 13 percent compared with December 2012 volumes, and totaled over 228 million contracts, and with full-year volumes up 10% compared to full-year 2012, according to its official press release.

The average daily notional value of FX contracts traded in December increased to $92 billion, up from $88 billion reported in November 2013, and December 2013 volumes for CME Group foreign Exchange (FX) averaged 760,000 contracts per day, down 8 percent from December 2012 -according to the press release – while FX options volume was up 20 percent year-over-year (YoY) during the same period.

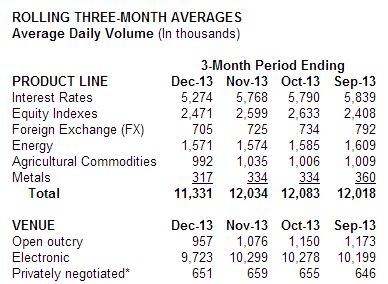

An excerpt from the announcement shows a rolling three-month average for each of its major product lines, including Foreign Exchange that had been on a steady decline during the 4th Quarter of 2013.

Source: CME

Eurodollar futures volume averaged 2.0 million contracts per day, up 51 percent from the same period a year ago. Eurodollar options volume averaged 652,000 contracts per day, up 142 percent from December last year.

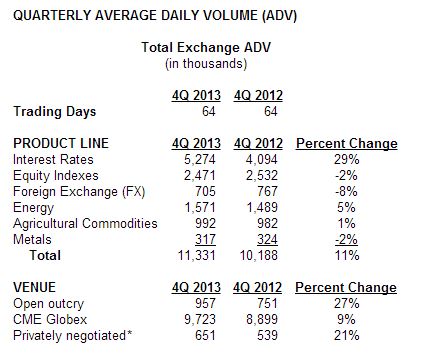

Comparing the 4th Quarter of 2013 with the same period during 2012 -which had the same number of trading days, Quarterly ADV was down from 767,000 to 705,000 or 8% lower for CME's Foreign Exchange segment.

Source: CME

Other Asset Class Segments and Instruments

In December 2013, CME Group became the global leader in over-the-counter (OTC) interest rate swap open interest. During the month, it increased 11 percent from the end of November to $9.1 trillion, as 418 market participants cleared trades at CME Group during 2013, as per the announcement. The group said it cleared an average $98 billion a day of notional value of OTC interest rate Swaps in December 2013.

CME Group equity index volume in December 2013 averaged 2.5 million contracts per day, down 7 percent from the same period last year. CME Group interest rate volume averaged 5.0 million contracts per day in December, up 38 percent from December 2012.

Treasury futures volume averaged 1.8 million contracts per day, up 6 percent compared with the same period a year ago. Treasury options volume averaged 536,000 contracts per day, up 66 percent from December 2012.

CME Group energy volume averaged 1.5 million contracts per day in December 2013, up 16 percent compared with the prior December. CME Group metals volume in December 2013 averaged 276,000 contracts per day, down 3 percent from December 2012. CME Group agricultural commodities volume averaged 793,000 contracts per day, down 10 percent compared with the prior year period.

Rising Trading Fees Counter Revenue Loss from Volumes Decrease

The subject of rising costs for CME members trading through the group's exchanges has been a subject of recent trade association concern, as the increase in costs to firms could deter liquidity just as other venues aim to lower costs in order to attract flows.

Alongside competitor ICE, CME group recently received regulatory approval for its Trade Repository in Europe, before 2013 came to an end.

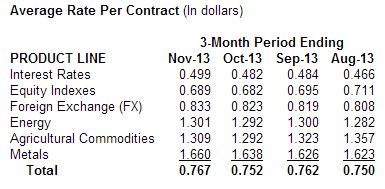

Excerpted from the CME reported figures today, the following chart shows the Average Rate Per Contract (ARPC) that CME earned in each of the last 4 trailing months respectively up until November 2013 - with a steady increase in the ARPC for FX despite a steady drop in FX volumes. Equity Indexes during the 3-month period ending November 2013 was lower when compared to the same period ending September and August but slightly higher than October.

Source: CME