Chicago-based CME Group (NASDAQ: CME), one of the world’s paramount Exchange operators, has published its August Options Review which showed a weak performance across the group’s overall business, according to a CME statement.

Take the lead from today’s leaders. FM London Summit, 14-15 November, 2016. Register here!

During August 2016, total FX options averaged 50,496 contracts per day, which represented a drop of -39.0 percent YoY from 82,510 contracts per day in August 2016. Across a monthly interval, the latest figures also reported a 19 percent decrease from 61,988 contracts per day in July 2015.

During the reported period, Mexican peso options ADV was higher +129 percent compared to last year and achieved record daily volume on August 11 with 3,230 contracts.

In addition, CME Group’s average daily Equity Index options volumes also pointed lower in August 2016, coming in at 517,102 contracts for the month, down by -33 percent from 774,679 in the same period of last year. In addition, the figure reflects another decrease on the monthly basis, down nearly 11.0 percent compared to 586,914 in the prior month.

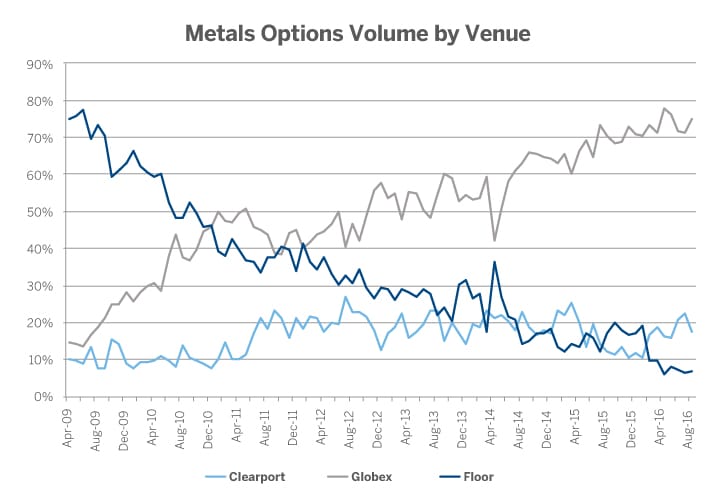

In terms of metals options, the holding company for CBOT, NYMEX, and COMEX exchanges averaged 32,650 contracts per day last month, which is a drop of -11.0 percent when compared to August last year’s figure of 36,640. Relative to the previous month, CME saw an ADV decrease of -10.8 percent MoM from 37,287 contracts in July 2016.

Metals options volume

Earlier in August, Finance Magnates reported on the CME Group when the company announced its Q2 financial results which managed to outperform the metrics of Q2 2015. During the second quarter the CME Group has managed to increase its revenue by 11 per cent when compared to last year, marking $906 million.