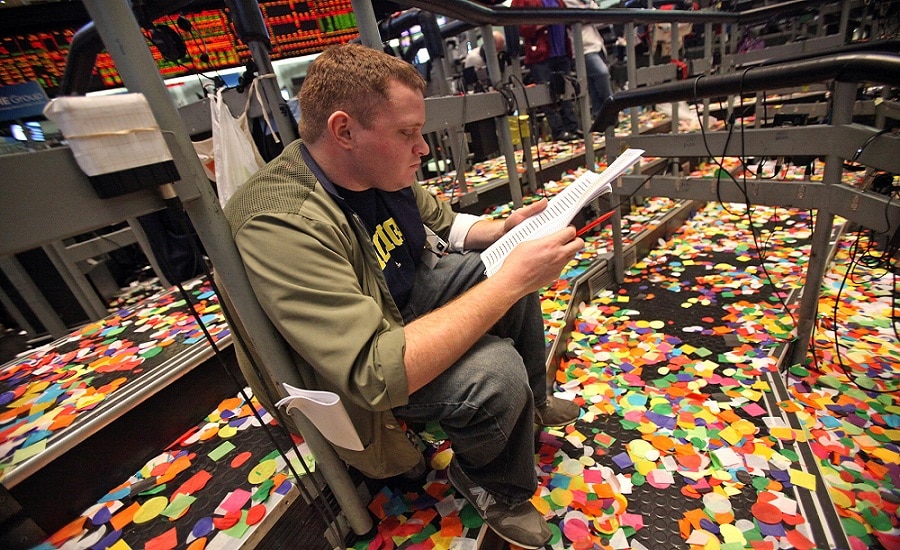

CME Group (NASDAQ: CME), one of the world’s largest derivatives marketplace, has reported its November 2016 volumes, which showed a strong upswing across all of its asset classes, as heightened market Volatility in the US election month boosted trading on the Exchange , according to a CME statement.

To unlock the Asian market, register now to the iFX EXPO in Hong Kong

The standout performance showed the highest ever average daily volume of 20.9 million contracts during November 2016, which correlates to a gain of 52 percent YoY from 13.712 million contracts in November 2015. Across a monthly timeframe, last month’s figures showed a more upbeat picture, mounting an increase of 62.6% from 12.832 million contracts in October 2015.

Meanwhile, CME has also notched growth across all of its six product lines YTD in 2016, which averaged 15.7 million contracts per day, up 12 percent from the same period a year ago.

For the month ending November 2016, CME Group saw its interest rate volume average 11.848 million contracts per day, which represents a jump of 73% YoY compared with just 6.866 million contracts in November 2015.

In a similar vein, foreign exchange volume in November 2016 jumped 39 percent YoY after averaging 987,000 contracts per day, against 713,000 contracts in the same period of last year. On the energy front, CME Group reported its energy volumes at an average of 2.772 million contracts per day during November 2015, up a staunch 41.0% YoY from 1.971 million contracts per day in November 2015.

In terms of Equity Indexes business, the volumes orchestrated a jump of 34 percent YoY after revealing 3.179 million contracts per day from only 2.367 million in November 2015.

Finally, CME Group’s Metals volume was more upbeat in its overall performance, managing to average 718,000 contracts per day in November 2016, which was good for a YoY advance of 71.0% vs. 419,000 contracts in November 2015.

Back in November, CME Group Inc. (NASDAQ: CME) reported a record high in single-day volume with more than 44.5 million contracts traded across all asset classes on November 9, 2016, the day after one of the most divisive US elections. The explosion of volatility and overnight pandemonium helped break the previous record of 39,567,064 contracts set on October 15, 2014.