After figures from Hotspot and FastMatch showed strong results for FX trading in January, activity at the CME Group during the month was tamer. For January, average daily volumes (ADV) of combined FX futures and options were 920,110 contracts. On a dollar notional level, ADV was around $87 billion.

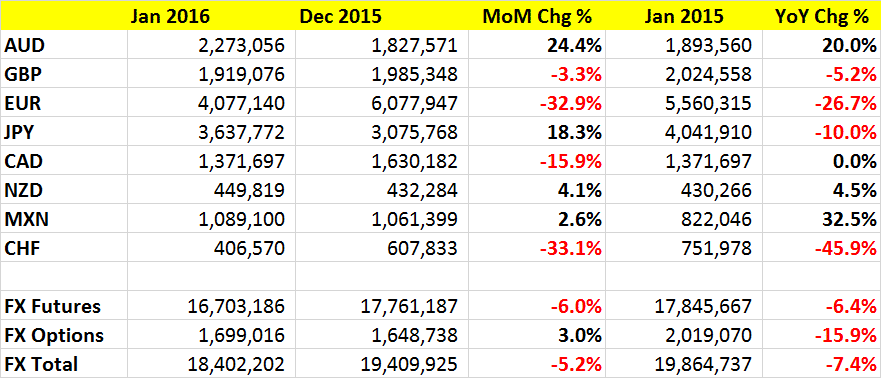

The activity was 4.3% ahead of December’s trading, but 2.7% below the same period in 2015. Overall, over 18.4 million FX contracts were traded during the month which was below December, but was higher on an ADV basis due to two fewer trading days in January.

Compared to FastMatch and Hotspot, January’s ADV growth at the CME underperformed- in these two venues, activity grew 25% and 27.5% respectively. However, during December, the CME saw a much larger increase in month over month trading compared to other venues.

Powering the month was a sharp increase in Japanese yen and Australian dollar trading. Demand in the yen has been buoyed by its roles as a safe haven currency during the current volatile period for many asset classes such as Equities . For the Australian dollar, speculation appears to be returning to the currency. Speaking with traders, they have related to Finance Magnates that the Fed’s decision to raise interest rates in December has reignited analysis of rate based trades in the Aussie.

CME Group December 2015 FX Trading Volumes (contracts)

(Editor’s note: ADV volumes are calculated using a 20 day month to match calculations to those used by major FX venues around the world compared to 19 days used by the CME Group’s official figures. The discrepancy is due to the Martin Luther King Jr. holiday which closed trading for many asset classes. However, FX trading was open at the CME. The CME Group’s official ADV figures are 970,000 contracts that equaled $92 million on a dollar notional basis.)