The operator of the Chicago Mercantile Exchange (CME) and other trading businesses, under the CME Group structure, today announced that beginning April 11th it will start clearing Interest Rate “Swaptions.”

As the name implies, the product combines features of a Swap and Option into a new contract, where the option portion of the contract gives the holder the right to exercise the underlying swap (depending if it's a payer or receiver swaption).

Commenting in the official press release, CME Clearing President Sunil Cutinho said: "CME Clearing is proud to be the first Clearing House to deliver interest rate swaption clearing, a capital efficient clearing solution that has the opportunity to transform the interest rate swaps landscape for our customers." He added: "Swaption clearing enables clients and dealers to substantially reduce their risk and gain margin efficiencies of up to 90 percent by adding swaptions to their CME cleared interest rate swaps portfolios."

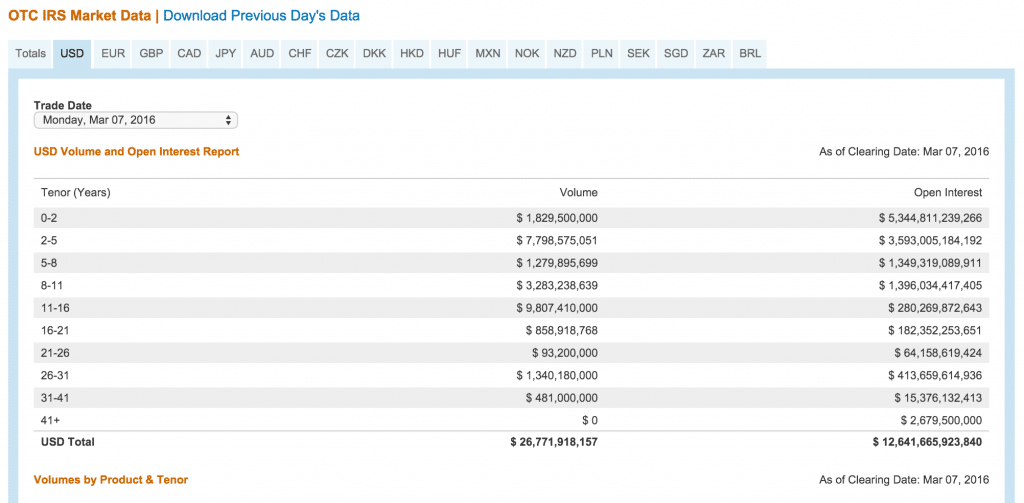

CME Group said that initially the product scope will include US dollar denominated Swaptions, and the contracts will have European style exercise, a maximum two-year option contract expiry, and maximum underlying swap duration of 30 years. Below is a snapshot for the Interest Rate Swap (IRS) related volumes according to data from the CME as of today:

Source: CME Group

Some members already approved

The company said it already has five of its clearing members approved to clear swaptions upon launch, and additional firms working through the approval process, according to the CME Group announcement today.

Royal Bank of Scotland's (RBS Plc) Alan Mittleman, Head of Rates Trading for the Americas, said: "RBS plc is pleased to take a leadership role as one of the first banks that will provide cleared swaption Liquidity to our global client base." He added: "We are very supportive of the early adopters that use the CME swaption clearing solution to reduce bilateral counterparty exposure, particularly with the added cost of margin for non-cleared derivatives coming later this year."

Also commenting in the official press release from CME Group was Credit Suisse's Global Head of Prime Derivatives Services John Dabbs: "With uncleared margin rules coming into greater focus for our clients, Credit Suisse is excited to facilitate voluntary swaptions clearing at CME Group."

"Clearing swaptions enables our clients to obtain the greatest operational and capital efficiencies from clearing, while reducing the risks in their portfolios," he concluded

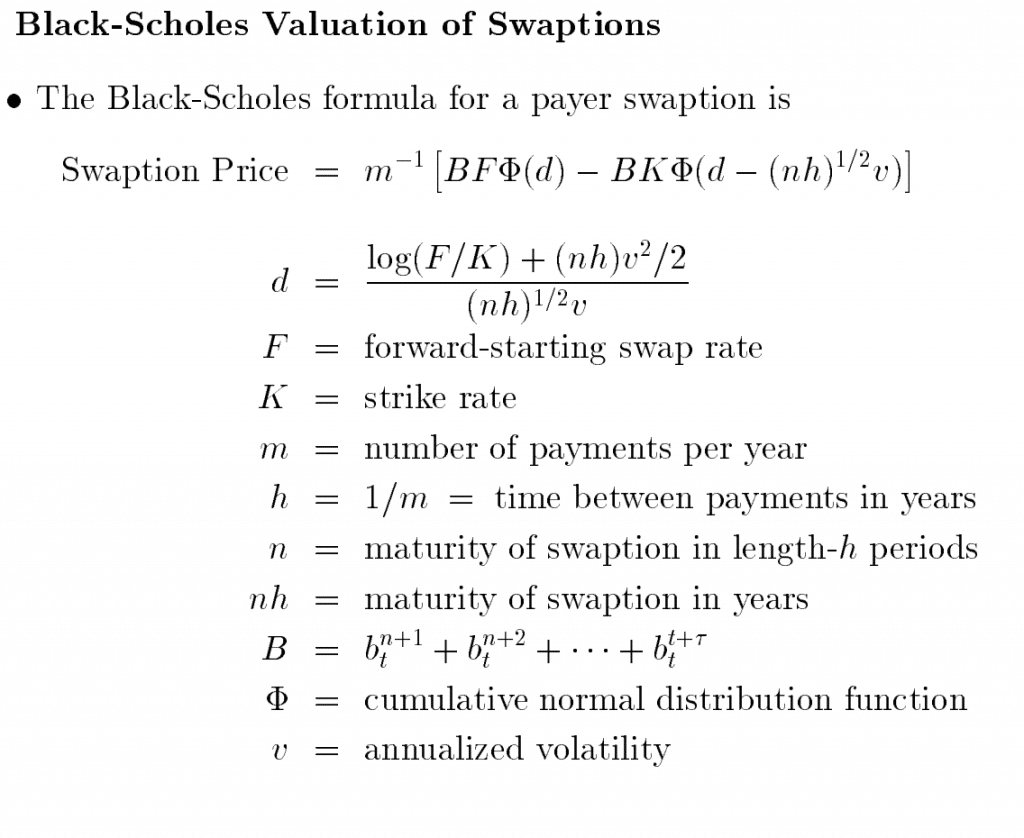

A stern school of business paper by Backus and Zin titled April 14th 1999, nearly twenty years ago, still summarizes how similarly Swaptions are calculated (when compared to a traditional European-style exercise plain vanilla option), yet is seen below as an example and not indicative of how the CME cleared products are handled: