Among FX brokers and trading venues, the chorus over the last few months of 2015 was that the market was waiting for the US Fed to make a move on interest rates. With the Fed meeting in the beginning of December, this meant subdued speculation from many FX traders during November and for some, even October. This environment was clearly reflected in trading volumes, and November marked a low for many FX participants.

With December arriving, and the Fed raising interest rates for the first time since 2006, expectations for renewed activity delivered results across the trading industry. Reporting their figures, FX trading at CME Group showed a sharp turn higher in December volumes compared to November’s quiet month.

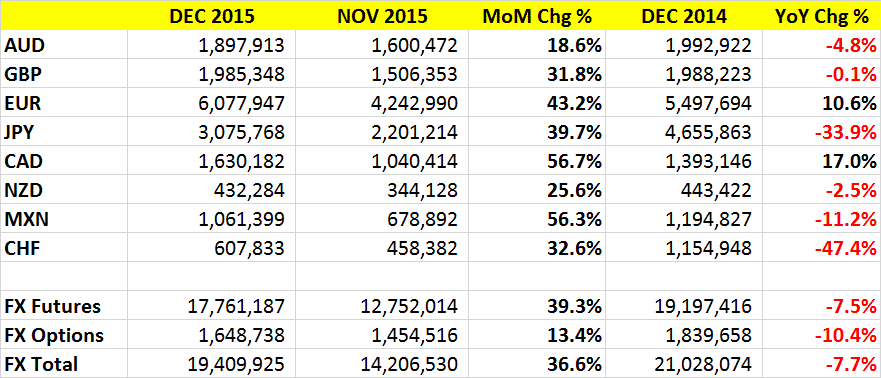

During the month, total FX futures and options volumes were 19.41 million contracts, or 924,282 contracts on an average daily volume (ADV) basis and $90 billion on a dollar notional basis. The ADV was 30.4% above November’s results. However, similar to results from Hotspot and FastMatch, FX trading at CME during December was below the same period in 2014, contracting by 7.7%.

Interestingly, volume growth was led by futures which outperformed the increase in options trading. In periods of rising speculation in the past, FX options tended to see higher growth than that of FX futures. As such, December’s trading behavior may have revealed that traders aren’t yet willing to be aggressive with their speculation on how changing interest rates will affect currencies as much as rebalancing their portfolios after the Fed meeting. If the latter, it may result in sluggish activity for the start of 2016.

CME Group December 2015 FX Trading Volumes (contracts)

Among individual currencies, trading in euro futures led all FX contracts. Along with the Canadian dollar futures, the two were the only major currencies to have also experienced year over year volume increases, in addition to growing when compared to November.

Elsewhere, it is worth noting the sharp year over year drop in Swiss franc futures trading. Trading over 1.15 million contracts in December 2014, that figure compared to only 607,833 in the same period in 2015. The drop off is worth noting in that despite a lack of Volatility in the Swiss franc in December 2014, the activity related that speculation in the currency was high prior to the Swiss National Bank’s decision in January 2015 to remove its 1.20 floor to the EURCHF Exchange rate.