The Trad-X platform operated as an FCA-regulated Multilateral Trading Facility (MTF) by Tradition UK Limited, just had Lloyds Bank join its platform as the twelfth founder, thus expanding its consortium of banks, according to an official press release today.

The MTF, operated by the Swiss listed inter-dealer broker Compagnie Financiere Tradition (CFT) group subsidiary, under the Trad-X brand platform, specializes in the trading of global interest rate swaps (IRS) in EUR, GBP and USD currencies , and is now supported by twelve banks. These institutions, via the Trad-X platform provide streaming in two-way prices for IRS derivatives. Trad-X was attributed to having matched orders for a value of nearly $2 trillion since inception.

Christophe Coutte, Head of Rates, Lloyds Bank Commercial Banking

Commenting in the official press release, Christophe Coutte, Head of Rates at Lloyds Bank Commercial Banking said, “We are very pleased to be joining Trad-X as a Founder and look forward to working with Tradition to grow hybrid capability in the GBP market, alongside its more mature currency offerings. Lloyds Bank supports market-led efficient trading solutions and Tradition has shown itself to be a leader in this area."

The CEO of Trad-X, Daniel Marcus, said in the announcement, “We are very excited to have Lloyds Bank as Founder on Trad-X. As one of the leading GBP banks, Lloyds will add further quality Liquidity , as well as product expertise and input in the development of our nascent GBP hybrid platform. We look forward to GBP IRS replicating the success of our USD and EUR offerings.”

Via its price discovery process from contributors, the Trad-x platform is described as providing around a hundred of the most liquid points on the Euro Interest Rate Swap curve, where 12 banks are now streaming prices electronically, and Trad-X also provides auction functionality in Interest Rate Options.

The electronic multi-asset class Trading Platform is explained as having hybrid features as well as fully automated functionality for OTC derivatives, and designed with the help of the trading community, Trad-X is an extension of Tradition's voice brokerage services.

The platform features are available through the Trad-X GUI or via its FIX API and through 3rd party software vendors such as ION, as explained in the press release.

Subscriptions for trade data are also available via providers such as Bloomberg and Reuters under respective mnemonics for each data page.

Initially launched in 2011 for IRS in EUR, and thereafter for USD and then GBP, the platform was designed together with market participants and founder streaming participants include BNP Paribas, Citigroup, Credit Suisse, Goldman Sachs, HSBC, Morgan Stanley, Nomura, Societe Generale, Royal Bank of Scotland and UBS, as per information on the Trad-x corporate website.

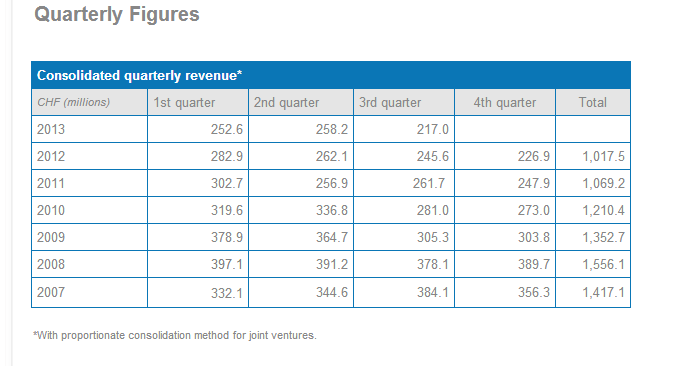

The news from its Tradition subsidiary follows the announcement from CFT of its twelfth member SocGen which joined its Parfx platform at the end of 2013. The broker is expected to report Q4 totals to tally up its yearly figures, after its revenues decreased in the Q3 2013, falling sharply over the prior quarter:

Source: Compagnie Financière Tradition quarterly figures