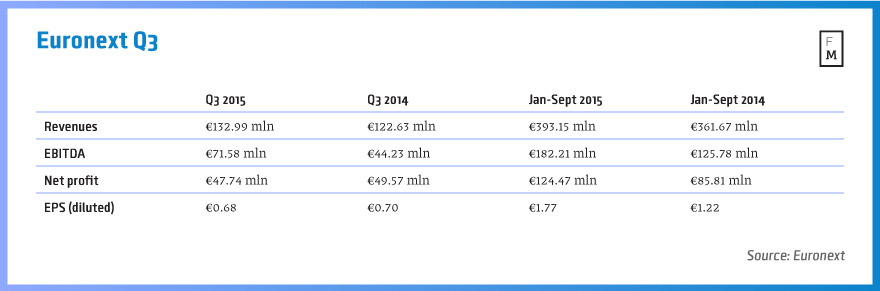

Euronext, Europe’s largest network of exchanges, reported a strong financial performance for the third- quarter of 2015, with net profits at €47.74 million ($51.94 mln), on revenues of €132.99 million, the company said in a press release. To compare, for the third-quarter of 2014, revenues were €122.63 million, although net profits were higher than for this year’s third-quarter, at €49.57 million. The operating result came in at €71.58 million, up substantially from €44.23 million.

Derivatives revenues up 5.3%

Derivatives trading contributed to the good results, Euronext said, with revenues in this business rising by 5.3 percent on the year in the three-month period, to reach €11.9 million. Index product volumes rose 3.4 percent, with the future contract on France’s CAC 40 blue-chip index remaining the most actively traded index future on Euronext.

Market Volatility

Cash trading did even better, with revenues growing 31.4 percent to €49.6 million, from €37.7 million for the third-quarter of 2014. Euronext attributed this robust performance to heightened market volatility in the period reviewed, fuelled by depressed commodity prices and worries about emerging markets.

Depressed commodity prices and worries about emerging markets help

China was a particular focus of attention following its stock market crash in June and the devaluation of the yuan. The Exchange went on to caution that these external events were very concentrated in time, hence the third-quarter performance cannot be considered as a reliable guide for any fourth-quarter outlooks.

Euronext released its trading volumes for October yesterday, which confirm the extraordinary nature of the drivers behind its third-quarter results. As Finance Magnates reported, October volumes declined on a monthly basis, with the metrics for September pushed up by that very same increased market volatility.