If you were impressed with the 38% MoM growth of FX trading as EBS reported earlier today, or the 32% increase during September at KCG Hotspot, you should be. But wait till you check out the CME Group’s numbers.

Knocking the ball out of the park, and providing their own Chicago/Aurora themed “We’re not worthy moment”, combined FX futures and options average daily volumes rose 64% during September to nearly 1.1 million contracts. On a dollar notional basis, trading is expected to be calculated at around $130Bln per day, with official results slated to be released later today from the CME.

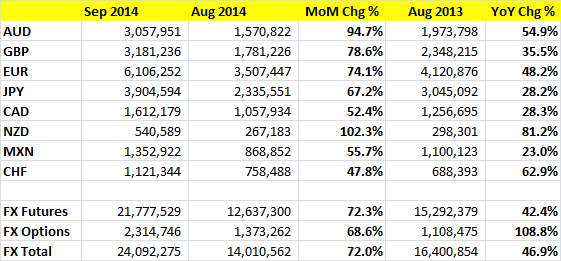

Overall, on a total basis (factoring in an extra trade day in September versus August) 24.09 million contracts were traded, 72% above August’s figures and 46% higher than the same period last year.

CME September 2014 FX Futures Contract Volumes

As reported in September, when the CME announced several FX trading and open interest records, volumes during the month were buoyed by the ECB’s quantitative easing expansion which was announced during their monthly Monetary Policy Meeting. In addition, pound trading gained interest due to speculation on the potential results of the Scottish Independence Referendum.

Overall, currencies are seeing renewed interest from not just FX participants, but Multi-Asset traders as well, due to renewed speculation in regards to the direction of global central bank policies. After near zero interest rates in the US, expectations are that the Fed will finally begin to nudge yields higher following economic growth in the country. In addition, with the ECB now taking the lead on aggressive asset-backed purchases which are expected to keep a bid on overall government and corporate bonds, the Fed has more leeway in contracting its easing policies.

For traders, this result has led to opportunities to bet on which central banks will in fact take the lead in tightening, which is expected to lead to increased demand. In individual currencies, the expectation of rising interest rates for the US dollar led to higher yielding currencies such as the Aussie and Kiwi to weaken against the Greenback and be among the most active contracts traded on the CME (See chart).