The CME Group has posted its monthly trading volumes for November. Total options and futures traded were 241,589,889 contracts, or 12.1 million per day. The average daily volume (ADV) was 8.1% above October’s trading activity. Boosting volumes were Interest Rate products which saw total volumes rise 7.5% from October and 25.3% from the same period in 2012. The group has been an outperformer at the CME this year, as speculation about when and if the FED will begin tapering has led to increased Volatility and volumes in interest rate products. Falling were Equity Index contract volumes, which saw monthly and year-over-year declines of over 20%. Despite all-time highs being set in the S&P 500 and Dow Jones indexes during November, the market’s optimism has led to a decline in expected volatility, causing a decrease in futures and options volumes.

FX Volumes Rise on Euro Trading

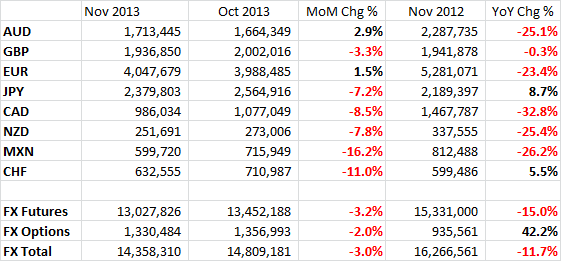

Also seeing increased activity were FX contracts in November. During the month, combined ADV of FX options and futures were 717,915 contracts, 11.1% above October’s figures. In dollar terms, average daily volumes of FX products was $88 billion. Due to fewer trading days in November, total volumes for the month were 14,358,310, a 3.0% decline from October and 11.7% below the same period in 2012. Similar to trading at the Tokyo Financial Exchange , CME Group volumes were led by trading in the euro and pound. After hitting historical lows in euro volatility in October, activity reignited in the currency as traders are speculating on coming policy changes from both the ECB and FED. Worth noting though, was a lack of meaningful volume growth in the Japanese yen. Yen trading had been closely aligned to activity in Interest Rate products. This correlation appeared to have faded during November.

CME Total November FX Futures Volumes