FXSpotStream LLC, a provider of multibank FX streaming aggregation and matching services across multiple asset classes, has published its inaugural monthly metrics, detailing its supported volumes across its core business.

The new world of online trading, fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

FXSpotStream is a wholly owned subsidiary of LiquidityMatch LLC – the group utilizes Liquidity from a total of twelve leading global banks, including such industry leaders as BofA Merrill Lynch, Bank of Tokyo-Mitsubishi UFJ, BNP Paribas, Citi, Commerzbank AG, Credit Suisse, Goldman Sachs, HSBC, J.P. Morgan, Morgan Stanley, Standard Chartered, and UBS.

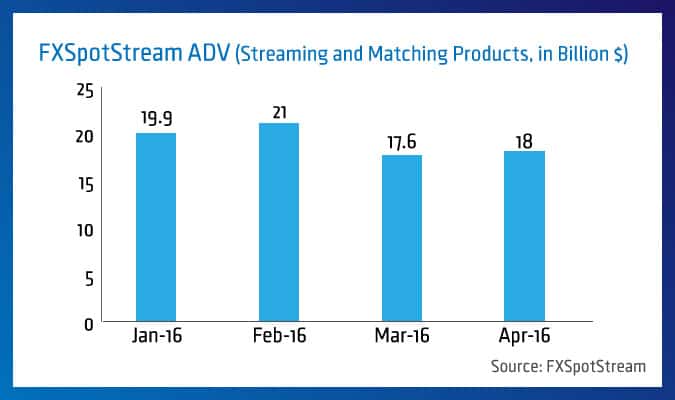

During the month of April 2016, FXSpotStream reported an average daily volume (ADV) of $18.0 billion, which represented a jump of 1.9% MoM from $17.6 billion back in March 2016. Furthermore, the latest figures also constitute a jump of 41.0% YoY in terms of volumes from April 2015 and encompass all of the group’s streaming and matching products.

Despite securing a small gain in April 2016, FXSpotStream’s ADV has been unable to reclaim a peak of $21.0 billion set back in February 2016. However, April 2016’s growing ADV came during a month of lighter trading, given a total of only 21 trading days, compared to 23 in the month prior.

Alan F. Schwarz, CEO, FXSpotStream

According to Alan F. Schwarz, CEO, FXSpotStream, in a recent statement on the volumes: “We started the streaming aggregation business in 2011 with just a spot FX API and 6 Liquidity Providers . In the last 4 plus years we have significantly expanded the streaming aggregation offering and now support trading in spot FX and spot precious metals, FX forwards and swaps and multiple order types, and we have doubled the number of Liquidity Providers to 12.”

“Today we have clients in all of the major financial centers, and to support our expansion we recently upgraded and doubled the capacity of our infrastructure in each of our co-location sites in New York, London and Tokyo,” he added.

Earlier this year, FXSpotStream made headlines when it was added to the Foreign Exchange Professionals Association (FXPA) as the latest member of its exclusive group of foreign exchange markets participants.