The owner of multiple exchanges under the Hong Kong Exchanges and Clearing (HKEX) Limited group structure has today reported its consolidated financial statements for 2015 following approval from its board dated (today) March 2nd 2016, and showing a rise across top line metrics for company's 2015 earnings.

Gross revenues and other income including fees totaled HKD $13.375 billion for 2015, up 35% from HKD $9.849 billion for the prior year (2014). EBIDTA was HKD $10.085 billion up from HKD $6.891 billion year-over-year (YoY), and resulted in a profit of HKD $7.931 billion after operating expenses, a sharp rise of 54% from HKD $5.138 billion YoY.

The diluted earnings per share settled at HKD $6.67 per share, up $2.24 per share or 50% reflecting the increased net profit from 4.43 per share for 2014. Shares of HKEX under ticker 388:HK closed up 3.5% to HKD $175 per share today around time of the news.

Profits Surge Despite Q4 Slump

The company's balance sheet remained robust as the decrease of 5.4% in total assets from $251.8 billion in 2014 to $238.1 billion for 2015 was more than offset by an 11.5% reduction in the total liabilities from $230.5 billion to $203.9 billion, and as higher revenue and subsequent earnings were realized.

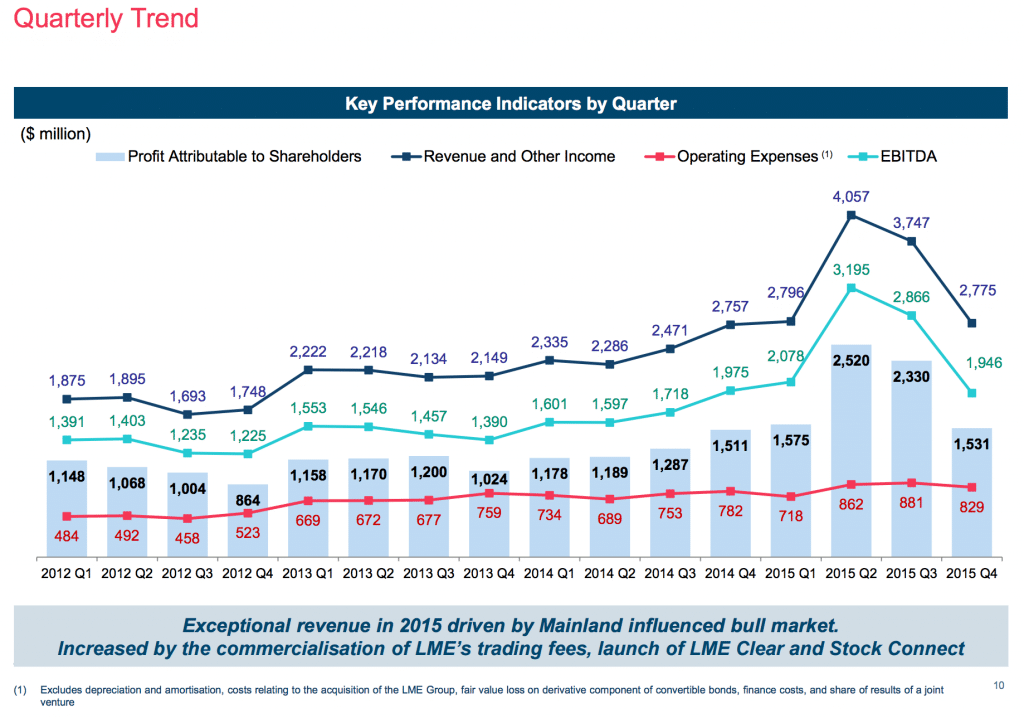

Net assets at the end of 2015 stood at HKD $14.595 after factoring equity and the above-mentioned liabilities against assets. From quarterly perspective results were lower from the Q3 peak, while still helping to contribute to the YoY increase, as seen in the excerpt from the HKEX's CEO presentation to investors earlier:

HKEX 2015 Financial Results

Source: HKEX Group

The exchange operator has controlling interests in nearly a dozen subsidiaries including full ownership of a number of business lines - such as the London Metals Exchange which recently revamped its trading pit.

HKEX owns a 75% controlling interest in OTC Clear. The company said that the accumulated non-controlling interests of OTC Clear at 31 December 2015 stood at $146 million, with the remaining 25% owned by a non-controlling interest, which doesn't have voting rights afforded by controlling members. The loss attributable to the company's non-controlling interests during the year amounted to HKD $25 million, lower than HKD $27 million YoY.

HKEX reorganized a number of its key business lines in mainland China as wholly foreign-owned enterprises, and its Stock Exchange Club Limited business was renamed as HKEX Investment (China) Limited effective on 29 February 2016, according to the nearly 100 page report that highlighted the group's yearly results.