Hotspot, part of Knight Capital has announced trading volumes for May. The foreign Exchange ECN has seen another positive month with average daily trade volumes for the month of May reaching $33.7 billion, an increase of 14% from a month earlier where the venue hit $29.5 billion.

Metrics

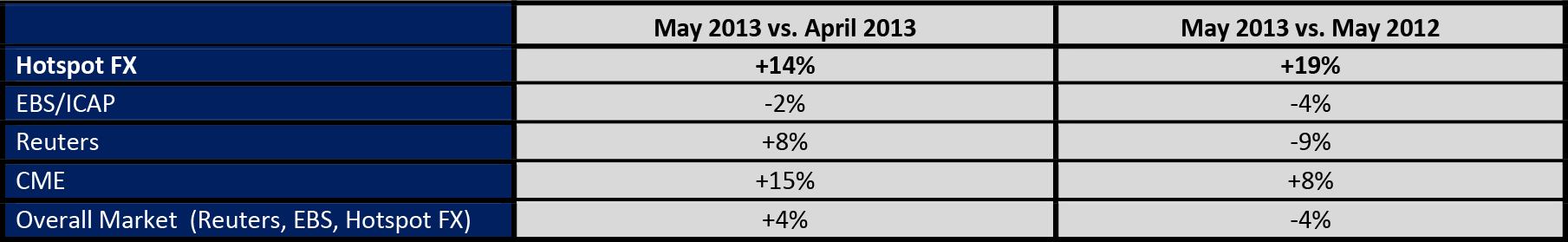

In May 2013, Hotspot FX volumes dramatically outperformed its peers. Average daily volume was $33.7 billion, a 14% increase from April 2013 and 19.3% increase year over year. A total of $774.7 billion was transacted which is a record in total volume for a calendar month. Among the publicly reported spot FX venues (Hotspot FX, ICAP/EBS, Reuters), Hotspot FX accounted for a record 11.2% of the market share in May 2013. Surpassing the previous market record set in April 2013 of 10.3%.

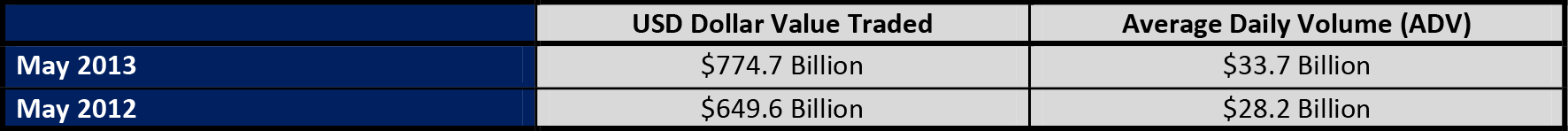

May 2013 Statistics (Single Count, USD):

- Hotspot FX posted an ADV of $33.7 billion. (based on 23 trading days)

- ADV increased 14.0% versus April 2013. (April 2013 ADV: $29.5 billion)

- ADV increased 19.3% versus May 2012. (May 2012 ADV: $28.2 billion)

- Total Volume: $774.7 billion. (Record Total for a Calendar Month)

Hotspot's extending volumes show consistency among all major FX venues that recorded increasing volumes, although April was more volatile with strong movements in Gold and the aftermath of the Cyprus crisis, May has continued the winning streak.

Volume Data - Source Hotspot

Hotspot is part of the pact of three ECNs that hold tier 2 status behind inter dealers; Reuters and EBS. FXall’s volumes have been climbing considerably since the venue launched over a decade ago and the ECN achieved the formidable $100 billion a day mark in December 2012.

Knight Capital came under the radar last year after major technical issues saw the market maker lose $460 million in one day due to a computer glitch. The market maker that holds 17.3% share of the NYSE (according to data supplied by the broker) was given a $400 million lifeline.

Volume other venues - Source Hotspot

The ECN market saw an influx of trading venues last year, each has its own niche with some opening their doors to high frequency trading and others looking at creating open trading environments.