ICAP, a leading market operator and intermediary, has published financial half-year results for the period March - September 2014.

Some of the key points include Group revenue decreasing by 9% to £620 million and a 46% increase in TriOptima's performance, helping the Group achieve £108 million in revenue, a 12% increase in the Post Trade Risk and Information division. Electronic Markets and Post Trade Risk and Information generated 83% of the Group's trading operating profit in H1 2014. In addition, ICAP has reported a daily volume high of $28 billion so far this year.

Source: ICAP

Michael Spencer, Group Chief Executive Officer (CEO), said: "Our first half results reflect a market environment that has remained relatively fragile; despite this, we are cautiously optimistic that we have started to see some welcome signs of activity and more positive sentiment returning in recent weeks."

Michael Spencer, Group CEO, ICAP

In Q2 and Q3 of this year, market conditions have been challenging for all market participants, including ICAP. The company cites the combination of "low and stable interest rates and historically low levels of volatility in foreign exchange markets resulting in subdued trading volumes across Global Broking and EBS."

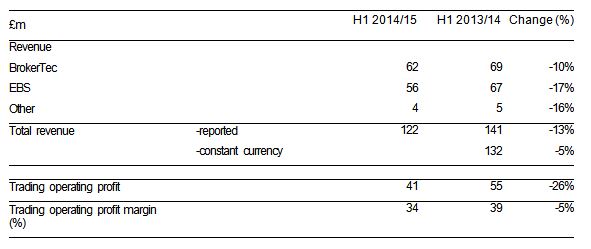

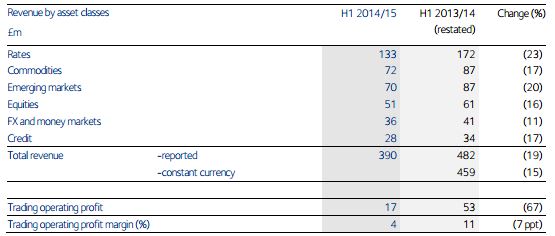

Year-on-year Global Broking revenue were 19% lower. Similarly, Electronic Markets revenue, because of weak EBS volumes, were down 13%.

Keeping with the trend currently emerging across the retail and institutional FX spaces, ICAP reported an increase in market volatility in September, in part fuelled by the Scottish Referendum and unexpected ECB action, "resulting in a stronger close to the period [March-September], a trend which has continued into October."

As a result, EBS Market once again achieved average daily volumes (ADV) in excess of $100 billion per day and an all-time daily record of $471 billion in US Treasuries was recorded on BrokerTec, according to the broker.

Howe Robinson Tie-Up

In addition to half-year results, ICAP has also announced that the company is in discussions to combine ICAP Shipping with Howe Robinson Group Pte Ltd, a leading ship-broking group, to create one of the world's leading businesses in the sector. The newly formed ship-broking company is expected to be operational in the second quarter of 2015.

The tie-up will see the established 131 year old Howe Robinson, a large privately owned dry cargo and containership broking houses, combine with ICAP Shipping, a prominent player in the ship-broking sector since 2007 with the acquisition of JE Hyde, followed by the purchase of Capital Shipbrokers the following year.

Despite the official announcement today, ICAP has left its options open by saying, “There can be no certainty that any transaction will be successfully concluded. Further statements will be made when appropriate." in a company statement.

Traiana

Traiana operates infrastructure for pre-trade Risk Management and post-trade processing across multiple asset classes. ICAP’s Triana product automates trade processing across the life cycle for a range of asset classes including FX, cash equities, fixed income and financial derivatives.

According to ICAP, Traiana's 'Harmony' network connects more than 550 global banks, broker-dealers, buy-side firms and trading platforms. Between March-September 2014, revenue increased by 8% to £25 million, just beating £24 million achieved in the same period last year.

According to ICAP, Traiana will diversify its business into other asset classes in the coming future, as well as adding hints that “particular investment in real-time credit management and allocation systems,” as well as “expansion of regulatory reporting into multiple jurisdictions,” is on the cards.

Electronic Markets

ICAP operates BrokerTec and EBS, the world's leading electronic trading platforms in fixed income and FX. Combined, the platforms offer trading solutions to more than 2,800 customers in over 50 countries.

Source: ICAP

EBS Market maintained its position as the primary interbank venue for FX trading. Historically low FX volatility has resulted in a 22% decrease in ADVs on EBS to $82 billion (March-September 2014). Year-on-year, revenue decreased by 17% to £56 million.

In a statement ICAP said, “More recently, September was characterised by a significant increase in volatility and improved trading conditions across all regions which has continued into October."

EBS Direct, the disclosed Liquidity service which was launched in November 2013, has demonstrated strong growth this year. By October 2014, ADVs on EBS Direct increased to $19 billion ($11 billion in June) and subsequently reached a single day record of $28 billion.

EBS Direct leverages EBS's extensive customer base, global networks and geographic reach. Since its launch, adoption of the platform has exceeded expectations with over 17 liquidity providers and 268 liquidity consumers using the service (including 35 non-bank institutions). EBS Direct is providing ICAP with new incremental revenue opportunities, for example, more than one third of the volume on EBS Direct was transacted in Commonwealth currencies. This has also supported an increase in Commonwealth activity on EBS Market.

A copy of the ICAP half-year results in full, can be found here