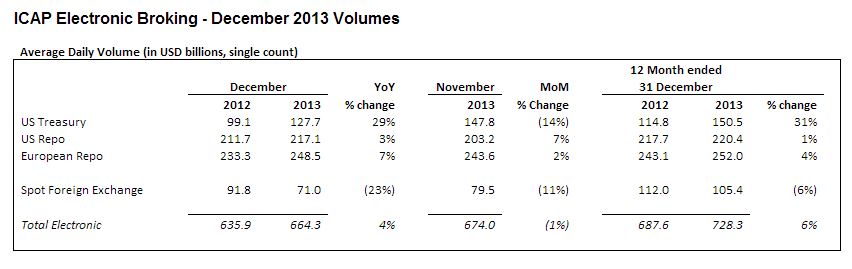

Several of the world's largest venues reported trading volumes today for December’s totals, with the latest reported from interdealer broker ICAP Plc, with Electronic Broking totals for December that came in at $664.3 billion – in average daily volume (ADV), up 4% year-over-year from $635.9 billion in December 2013, and down 1% month-over-month (MoM) from $674 billion in November 2013, for its combined US and European Repo, and US Treasury lines -as well as Spot Foreign Exchange business.

From these figures, through its EBS platform, Spot FX volumes suffered a 23% drop in December 2013 when they reached $71 billion in ADV at the month's end- when compared to the same period YoY, according to data in the announcement, and down 11% MoM from November's totals of $79.5 billion.

The excerpt below from the announcement shows that, among other figures, its Spot FX volumes stayed below the 12 month average of $105 billion, which was also down 6% from 2012's 12 month average (ending December 31, 2012) of $112 billion in average monthly ADV.

Source: ICAP

The Group matches buyers and sellers in the wholesale markets in interest rates, credit, commodities, FX, emerging markets and equity derivatives through voice and electronic networks, and operates a diverse business with considerable aggregate volumes across all markets totaling in the trillions.

While FX may represent a portion of its overall business, it nevertheless is an important segment that has recently had its volumes under pressure, although recent changes are aimed at repositioning the company's offering - such as EBS Direct -previously covered by Forex Magnates in November. A recent BIS survey cited such shifts in trading volumes as global trends which have affected FX flows.

Shares of ICAP are trading up over September 2011 levels of 450 pence per share and higher by over 1%, near 443.10, around time of publication.