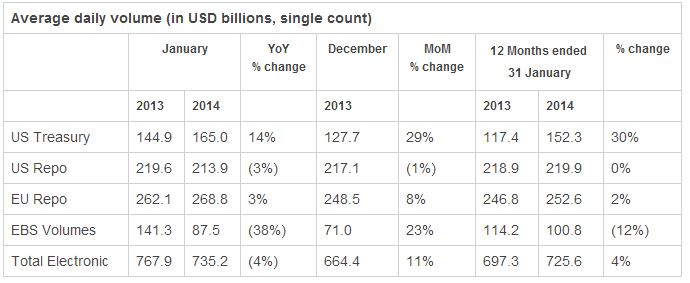

Interdealer ICAP has posted its January trading volumes. For the month average daily volumes (ADV) of electronic brokering on the company’s platforms was $735.2 billion, 11% above December’s figures but 4% below the same period in 2013. In FX, the firm’s EBS platform, which now includes both its ECN and relationship trading, ADV rose 23% from December’s multi-year low to $87.5 billion. Volumes though were still well below the $141.3 billion in ADV that was achieved in January 2013, as a spike in yen volatility led traders back towards the deep Liquidity available on the EBS platform.

As technology has lowered the barrier for firms to access relationship-based pricing, it has led to an increase in individual institutional FX buyers creating their own ECNs. This trend had led to a booming market in Liquidity Aggregation software, which ICAP hopes to tap into with the launch of EBS Direct as a relationship-based platform that operates alongside the ECN EBS Market product. Among competitors, Thomson Reuters has seen benefits in this strategy, as volumes traded using its FXall software surpassed its Reuters FX matching engine in 2013. According to ICAP, EBS Direct currently has 400 customers and 12 liquidity providers on the platform.

Precious Metals Arrive on EBS Direct

Building on its EBS Direct FX offering, ICAP also announced today that they are launching precious metals trading on the relationship-based trading platform. According to the firm, users will be able to trade gold, silver, platinum and palladium in US dollar and euro denominations on EBS Direct. In its launch, Societe Generale has been signed as the product’s initial liquidity provider of metals.

Commenting, Hugh Whelan, Director of Liquidity Management at EBS Direct, stated, “We are responding to significant demand from our customers, who look to EBS Direct to deliver robust and reliable liquidity, to all market participants.” Azeem Malik, Head of E-business Metals Markets of Societe Generale added, “We are proud to be the first providers of liquidity for precious metals on EBS Direct, further cementing our partnership with EBS. Our initial trades have gone well and we look forward to increasing the volume of trades with EBS.”