Intercontinental Exchange (NYSE: ICE), the global network of exchanges and clearinghouses, today reported its operating volumes for the month ending August 2015, according to a just released ICE statement.

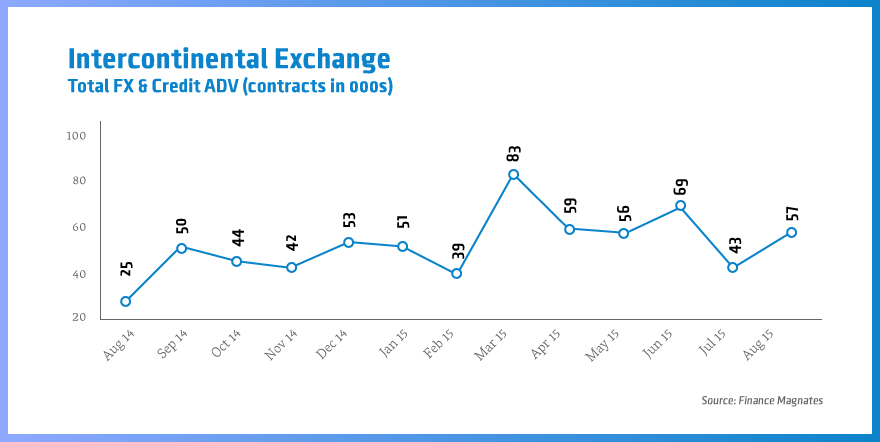

One interesting area of growth during the month ending August 2015 was seen in ICE’s total foreign exchange (FX) and credit at ICE – August 2015 saw an average daily volume (ADV) of 57,000 contracts, besting July 2015’s figure of 43,000 contracts by a factor of 32.5% MoM. Expanding the perspective to include last year’s figures, August 2015’s 57,000 contracts represent a 133% growth YoY from 25,000 contracts in August 2014.

ICE’s August 2015 futures and options ADV increased 11% compared to August 2014. Commodity ADV increased 23% led by Brent, gasoil, other oil, natural gas and sugar ADV up 25%, 28%, 35%, 11% and 27% respectively, from the prior August.

Financials ADV declined 4% from the previous August, which the group explained was primarily due to low European short-term interest rates, partially offset by a 29% year-over-year increase in equity index futures due to market Volatility .

NYSE’s U.S. cash equities and equity options ADV increased 62% and 17%, respectively, over the prior August. NYSE’s U.S. cash equities market share was 24.6% and NYSE’s U.S. options market share was 20.3%.

Last month, ICE reported its financial results for Q2 2015. For the quarter ending June 30, 2015, consolidated net income attributable to ICE yielded $283 million on $797 million consolidated revenues less transaction-based expenses, marking a drop from strong first quarter metrics. In addition, diluted earnings per share (EPS) in Q2 2015 were $2.54, down from $2.80 in Q1. Excluding acquisition-related expenses, Q2 2015 adjusted net income from continuing operations increased 27% YoY to $323 million.