Exchange traded volumes reported today for the month of January by the IntercontinentalExchange Group, included foreign exchange trading volumes across futures and options as well as its popular U.S. Dollar Index product offering, alongside an array of related metrics reported by the group for the first month of 2014, which had mixed results.

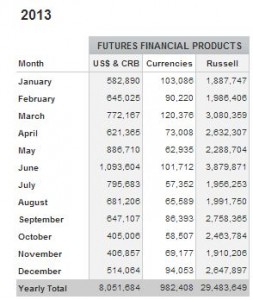

The figures included ICE's results compared from a year-over-year basis, across various asset classes and instruments under its multi exchange operated business lines, including FX totals -from ICE Futures US - of 26,000 contracts in average daily volume (ADV) for the month of January 2014, and lower by 3,110 contracts over Decembers ADV of 29,110.

Total volume over 21 trading days in December was 611,000 contracts, and January tallied 546,000, calculating the ADV across the same total number of trading days for each month.

December FX Tapering Lingers Into January

December lows were previously reported as down 12% YoY (over December 2012), and that downtrend continued with this January's figures tapering further by 19% over January 2013.

ICE’s full fourth quarter 2013 results and earnings will be reported on Tuesday, February 11th, and today's news follows the group's regulatory approval from the Monetary Authority of Singapore (MAS) to acquire the Singapore Mercantile Exchange (SME), as covered by Forex Magnates just days earlier.

Source: ICE

ICE’s January average daily volume (ADV) for global derivatives was 10.4 million contracts in January, a decrease of 8% YoY, while total commodities ADV increased 15% over the same period - driven by strength in natural gas and agriculture contract volume, according to the official company press release.

Also noted was that total financial ADV declined 24% primarily due to lower Volatility in European interest rates relative to the strong volumes in January 2013, as a result of the long-term repo operation (LTRO) repayment. This was partially offset by a 20% increase in equity index ADV driven by volatility in the equity markets. ICAP today cited similar trends in its treasury business, after reporting January totals this morning in London.

The firm's U.S. cash equities ADV declined 2% in January when compared YoY, and European cash equities ADV increased 22% from the prior January, as per the press release highlight. Shares of ICE on the NYSE were trading down 1.62% around time of publication by Forex Magnates.

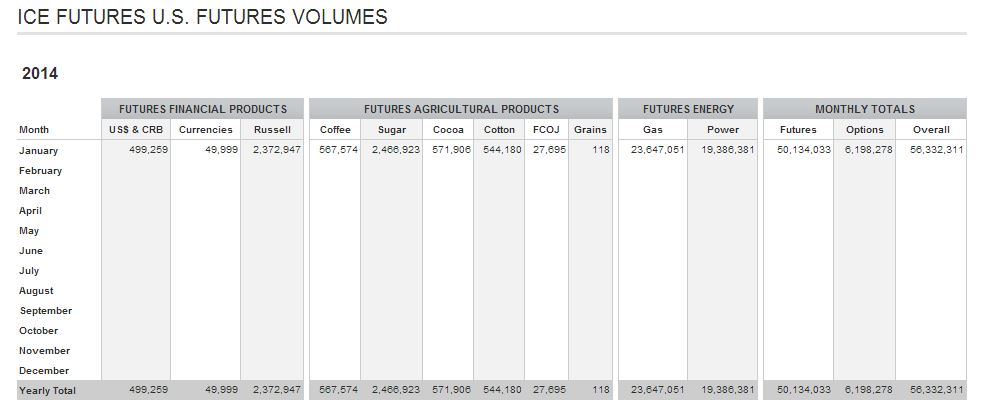

An excerpt of monthly totals for January provided from the historical reporting section on the ICE website, shows January totals from ICE Futures US business -populated for the first month of 2014:

Source ICE: ICE US Futures 2014 Totals

The full press release can be found on the investor releases section of the ICE group corporate website.