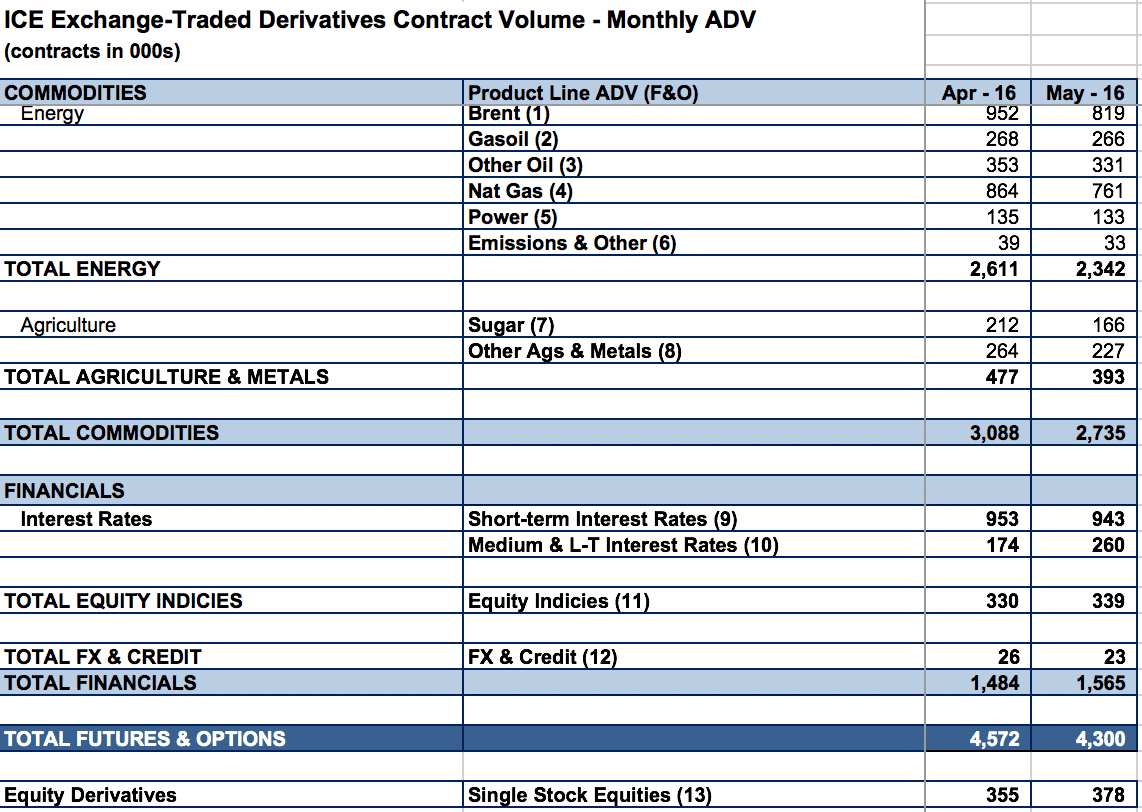

Trading statistics have just been reported by Intercontinental Exchange (NYSE: ICE), for the month of May 2016, from its ICE and NYSE operated venues, showing a decline of 6.5% in overall average daily volumes (ADV) from 4.6 million contracts per day in April to 4.3 million in ADV during May.

Following a strong start to the year, with the year-to-date ADV still 5,168,973 contracts for ICE's reported totals, the quarter-to-date ADV has declined to 4,436,813 contracts, and with May's results dragging ADV to 4.3 million, and lower than April's.

May has already shown to be a slower month for many venues that have reported trading results for the prior month so far in June, as per related coverage by Finance Magnates, while some venues did report an improvement compared to April.

FX volumes down 10%

Foreign exchange and credit volumes totaled 488,987 in May and ADV declined to 23,285 contracts during the month, down from 26,000 in ADV reported in April for this product segment, according to the data reported by ICE.

Trading in the US Dollar Index (USDX) made up the bulk of this segment, with 19,876 contracts in ADV in May, while the remaining 3,409 ADV was from the FX and other financials reported for the company's foreign exchange products.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

Interest Rates mixed

Medium and long term interest rates products also rose sharply in May reaching 260,000 contracts on average per trading day, up from 174,000 in ADV reported for April. However, short-term interest rates saw ADV fall in May to 943,000 contracts from 953,000 compared to the prior month.

Equity indices products showed higher ADV in May reaching 339,000 contracts per day, up from 330,000 in ADV reported for April, as per the May trading statistics reported by ICE today.

Energy Leads segment decline

Within this segment, energy products totaled 2.34 million ADV through May across energy products, lower from 2.66 million in ADV during April, while the remaining agriculture and metals volumes declined in May to an ADV of 393,000 from 477,000 contracts traded per day on average in April.

Overall, including energy, agriculture, and metals, the commodities' segment had an ADV of 2.73 million, down from 3.08 million in the prior month. An excerpt of one of the supplemental data reports from ICE to the May trading results can be seen in the below table including April's totals.

Source: ICE