Intercontinental Exchange (NYSE: ICE), a global network of exchanges and Clearing houses, has reported its volumes for the month ending October 2015, according to a recently released ICE statement.

Last month, ICE’s September 2015 futures and options average daily volume (ADV) yielded 4.7 million contracts, or decline of -6.0% YoY compared against September 2014. Alternatively, commodities ADV was reported at 2.7 million contracts in September 2015, climbing 3.0% YoY from 2.6 million contracts in September 2014 as well.

For the month ending October 2015 however, futures and options ADV came in at 4.7 million per day, which was virtually unchanged MoM from 4.7 million contracts per day in September 2015. However, over a yearly timeframe, October’s volumes witnessed a marginal decline of -2.0% YoY from 4.8 million contracts in October 2014. By extension, commodities ADV secured a slight growth, having been reported at 2.8 million contracts per day in October 2015, against just 2.7 million contracts in September 2015, or 5.0% MoM.

Moreover, equity indices ADV on ICE came in at just 330,000 contracts per day in October 2015, falling -47.5% MoM from 628,000 contracts in September 2015. This loss was slightly smaller when measured against its 2014 equivalent – October 2015’s performance substantiates a loss of -31.0% YoY from 476,000 seen in October 2014.

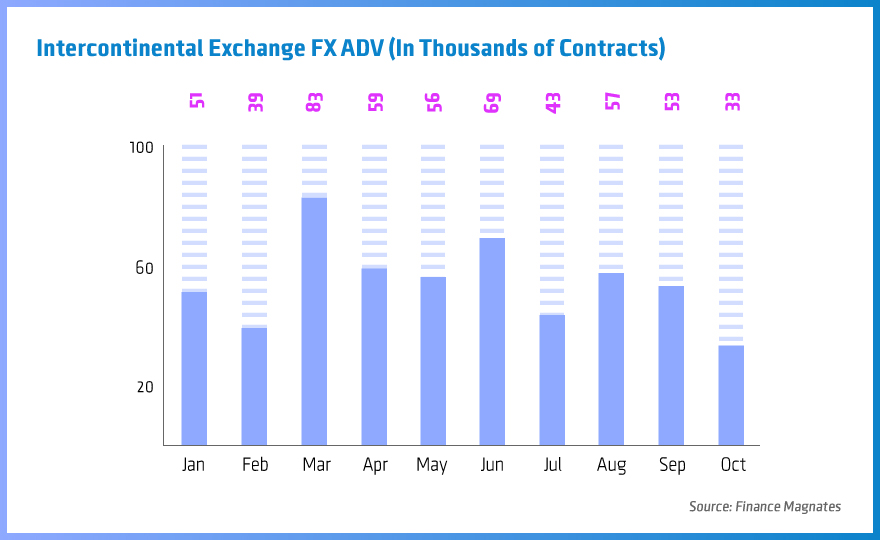

ICE’s foreign exchange (FX) and credit volumes were also unable to orchestrate any strong performance in October 2015 – an ADV of 33,000 contracts in October represented a plunge of -37.8% MoM from 53,000 contracts per day in September 2015.

Expanding the snapshot to include last year’s figures, October 2015’s ADV of 33,000 contracts also correlates to a YoY decline of-25.0% YoY from 44,000 contracts per day in October 2014.

Last month, ICE released financial results for Q3 2015 ending September 30, 2015. During Q3 2015, ICE unveiled a consolidated net income of $306 million on $816 million of consolidated revenues less transaction-based expenses – this represented a gain of 9.5% YoY from $745 million in Q3 2014. Furthermore, ICE reported diluted earnings per share (EPS) of $2.76 in Q3 2015 on a GAAP basis, a substantial jump of 53.0% YoY from Q3 2014.