Intercontinental Exchange (NYSE:ICE), a global network of exchanges and clearing houses, has reported financial results for Q3 2015 ending September 30, 2015, according to an ICE statement.

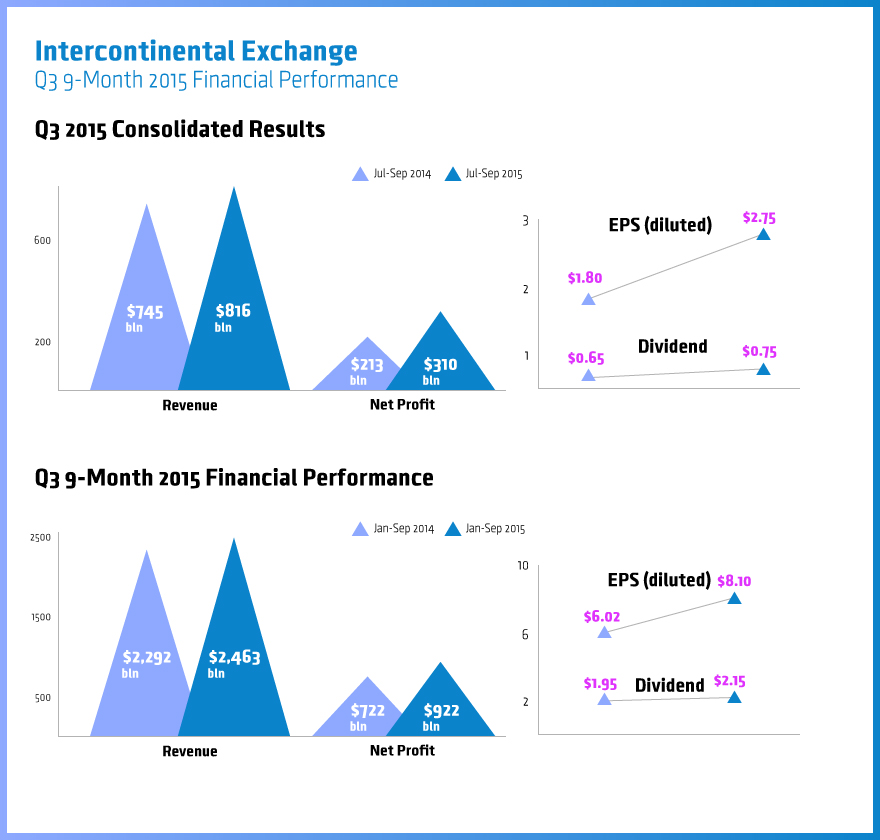

During Q3 2015, ICE unveiled a consolidated net income of $306 million on $816 million of consolidated revenues less transaction-based expenses – this represents a gain of 9.5% YoY from $745 million in Q3 2014. Furthermore, ICE reported diluted earnings per share (EPS) of $2.76 in Q3 2015 on a GAAP basis, a substantial jump of 53.0% YoY from Q3 2014.

Additionally, operating income was also on the uptick in Q3 2015, with ICE orchestrating a figure of $440 million, compared to just $330 million in Q3 2014, good for a jump of 33.3% YoY.

Other points of emphasis include ICE’s consolidated data services revenues Q3 2015, which came in at a record $209 million, up 24% YoY – meanwhile, listings revenues were $101 million, up 10% YoY against Q3 2014. Finally, consolidated operating expenses were $376 million Q3 2015, which included $6 million in NYSE integration costs.

According to ICE Chairman and CEO Jeffrey C. Sprecher in a recent statement on the quarterly earnings: "Our third quarter performance represents our fourth consecutive quarter of double-digit earnings growth. This was driven by strong performance in our commodities, cash equities, data services and listings businesses. Our focus on our customers and on our strategic objectives is providing near-term and long-term growth across all of our businesses.”

“We drove growth through a range of organic initiatives, while continuing to reduce expenses and expand operating margins. We also generated strong cash flow and maintained a strong balance sheet with low Leverage which enabled us to return $847 million to shareholders through dividends and share repurchases during the first nine months of the year," added Scott A. Hill, ICE CFO.

Earlier this week, ICE formalized its plans to acquire Interactive Data Corporation in a move valued at approximately $5.2 billion. The landmark acquisition will help ICE assimilate with Interactive Data’s financial data capabilities, which serves a variety of sectors, including mutual funds, banks, asset managements, hedge funds, and securities, among others.