BT Radianz Cloud has added another Asian exchange group to its network, Japan’s JPX, which includes the Tokyo Stock Exchange and the Osaka Securities Exchange. The deal allows BT’s expanding, networked financial community to trade more easily on JPX exchanges by providing easy, low-latency access to Japanese market data, brokers and other trade cycle applications and services.

Explore the Japanese FX and Fintech Scene at Tokyo Summit 2015

BT’s networked financial community can trade more easily on JPX exchanges with easy, low-latency access.

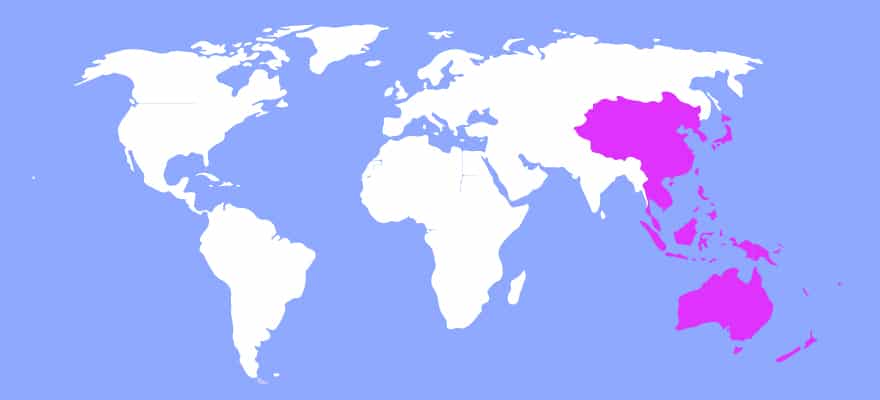

BT Radianz Cloud already has a strong presence in the Asia-Pacific region, boasting more than 3,000 members and Hosting the Australian Securities Exchange (ASX), Bursa Malaysia and the Singapore Exchange (SGX) on its single network connection. Given JPX’s stature as the third largest exchange group in the world, some would say that it is high time for such a move.

The deal also highlights JPX’s ambition to extend its global reach and connectivity, with a number of moves in that direction since its establishment in 2013.

In a public statement, Mitsuo Miwa, Director of Market Business Development at JPX, said: “Global investors have high hopes for the Japanese economy and for us, this creates an opportunity for growth. JPX’s ambition is to become the most preferred exchange in Asia and one of the most competitive in the world. We’ve chosen to work with BT because of its proven experience and creative use of technology. We’ve been impressed by its track record in helping exchanges extend their global reach and we look forward to leveraging this to deliver growth.”

With JPX now on board, we have the infrastructure in place to help grow trading activity and investment into and out of Japan.

With JPX joining BT Radianz Cloud, traders are now able to reduce time to market, expand their reach into international markets and also attract greater Liquidity into the region. Tom Regent, President, Global Banking & Financial Markets, BT Global Services, concluded: “With JPX now on board, we have the infrastructure in place to help grow trading activity and investment into and out of Japan. This will make it easier for our community to do business in a way that can lead to a more vibrant market, boosting Japan's standing as a global financial hub.”

For more information about participating in our Summit or exhibiting and sponsorship opportunities please email summit@financemagnates.com