The Japan Exchange Group (JPX) today has reported its unaudited consolidated results for the second fiscal quarter ending September 30, 2016, which took a step back across a number of key measures, ultimately paring the last quarter’s slight gains.

The FM London Summit is almost here. Register today!

During the Q2 FY2016, JPX witnessed a mild drop across multiple key figures and areas of its business. This was seen primarily in the area of its operating revenue, which dropped to $501 million (¥52.882 billion) during the reported period, having declined -8.7% YoY from $549.81 million (¥57.952 billion) during the year prior. The decline in revenues was mainly attributed to lower trading volumes and values.

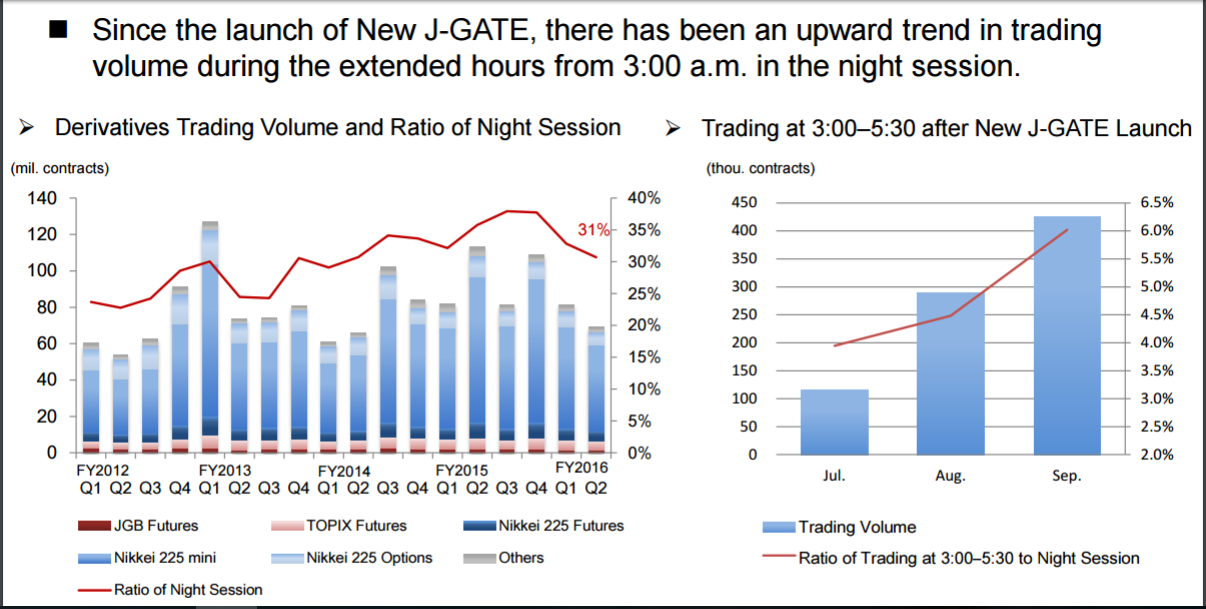

Another area of weakness for the quarter was JPX’s operating expenses which orchestrated a rise up to $242.78 million (¥25.593 billion) in Q2 2016, higher 9.8 percent YoY from $221.07 million (¥23.302 billion) in Q2 2015. This figure was largely influenced by negative impact of accelerated depreciation of the old J-GATE derivatives trading system.

Source: JPX

However, the worst component of its metrics was across its income – with regard to the JPX’s operating income during the second fiscal quarter, the venue reported a figure of $268.09 million (¥28.258 billion) which corresponded to a drop of -19.9% YoY from $334.91 million (¥35.295 billion) for the same period in 2015.

This trend was reiterated across the JPX’s net income for the same period ending September 30, 2016, justifying a figure of $185.95 million (¥19.597 billion) or -17.9% YoY from $226.56 million (¥23.879 billion) during the previous year.

JPX’s earnings per share (EPS) yielded $0.19 (¥21.0) during the Q2 FY2016. This was reflective of no change from the previous year.

Finally, JPX’s revenues from trading services and clearing services also pointed lower during the last quarter due to a YoY decrease in overall trading. By contrast, other revenues reversed the narrative, having yielded year-on-year solid gains due to upticks in Colocation and network usage fees.