The London Stock Exchange announced on Friday that it is to acquire the derivatives business of Turquoise Global Holdings, in which it currently owns a 51% stake.

The existing derivatives platform is set to be renamed 'London Stock Exchange Derivatives Market', and whilst continuing its existing functionality, will now do so as part of a Regulated Market of a Recognized Investment Exchange (RIE).

The change in status is aimed at helping the market to prosper in the face of upcoming post-trade regulations which would classify trades made at a multilateral trading facility such as Turquoise as over-the-counter and thereby subject to higher collateral costs had the CFTC and banking regulators gone down that route at the time.

Collateral Cost On The Up For OTC Products?

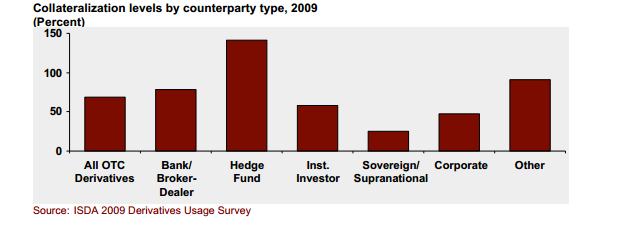

If occurrences in the United States can serve as a precursor to those in London's derivatives market, there is a potential reality that costs may go up for OTC derivatives trading. In the United States in 2009, corporations were 47% collateralized for their OTC derivatives trades; while full collateralization was unlikely and would potentially double their costs.

while corporations were looking at Dodd-Frank, Basel III came out of the development pipeline. End-clients of over the counter (OTC) derivatives trades have two options for getting the needed exposure regardless of whether the trade is a commercial hedge or a speculative investment: the trade is either directly with the derivatives dealer, what is known as a bilateral trade, or the trade can be done on a CCP.

In a bilateral trade, a bank takes the risk of the position. In a non- or under-collateralized trade, this leaves the bank exposed to potential losses if the end-user counterparty goes bankrupt. Looking at the trade from a Basel III perspective, this produces a liability on the bank’s balance sheet and that in turn produces a capital charge. Under earlier versions of Basel this may have been acceptable, but under Basel III these capital charges will be high and costs will be passed through to clients.

Aimed at strengthening bank Liquidity and lowering Leverage , the Basel III directive was intended to be implemented between 2013 to 2015, however changes to the proposed structure have delayed this until 2019.

Multilateral Trading Facilities

The regulations defined under MiFID make a specific distinction between a multilateral trading facility (MTF) and an exchange, MiFID breaks down these concentration rules and aims to facilitate competition between different types of trading venues: Regulated Markets (RMs), MTFs, Systematic Internalizers and investment firms trading away from RMs and MTFs (i.e. OTC).

To support price formation and investor protection in a potentially more fragmented trading environment, it also introduces universal transparency requirements across the European Economic Area (EEA) to help facilitate price formation. The intention being that an adequate level of pre- and post-trade information contributes to the effective operation of a market and to investor protection.

Greater transparency would also help to minimize the potential consequences of fragmentation in trading, such as inefficient price formation.

In addition to opening up competition among trading venues, MiFID introduces competition in trade publication services by giving investment firms, when trading OTC, choice in where they publish their transparency information.

This introduces a possibility that trade information will fragment. Fragmentation of transparency information, if not addressed properly, could undermine the overarching transparency objective in MiFID, and may even result in less transparent markets than is the case today.

In order to achieve efficient price discovery and facilitate achievement and monitoring of best execution, trade information published through different sources needs to be reliable and brought together in a way that allows for comparison between the prices prevailing on different trading venues.

It should be available in a format that is easy to consolidate and that is capable of being readily understood and be available at a reasonable cost.

Subsequent to its takeover by London Stock Exchange, Turquoise will continue to operate a pan-European cash equities MTF.

Increase In Popularity Among OTC Participants

Completion of the transaction, which is subject to certain conditions, including regulatory non-objections, is expected to take place during Q4 2013.

To explain the difference in practical terms, under an exchange driven model, the meeting of buying and selling interests would typically be on an anonymous basis with multiple buying and selling interest coming together to create a central pool of liquidity.

Currently, under MiFID there are two types of exchange, which are as described above: RM or MTF. Both relate to a system which brings together multiple third party buying and selling interest, although the venues are regulated differently:

It was proposed at the 2009 Pittsburgh G20 summit that all standardized OTC derivative contracts should be traded on exchanges or electronic trading platforms, and cleared through central counterparties by the end of 2012, and that OTC derivative contracts should be reported to trade repositories.

Until now, stand alone MTFs have generally speaking been notable by their absence in the OTC derivatives field, LMAX Exchange being the only FCA regulated MTF which garners significant FX business. Whether LMAX will continue to offer FX brokerage activities or focus on exchange-related business in future is not known and any guess on this would be purely speculative, however the new entrant MTFs are popular among high frequency traders and those members who participate in being paid to trade on the platform as long as the trading adds liquidity rather than takes it.

Largely, MTFs have been run by investment banks, however the individual ones have experienced limited success thus far, pinpointed by the closing down of NASDAQ OMX in 2010 and the initial weakness in business accrual that led to London Stock Exchange acquiring its first stake in Turquoise.

However, with UBS MTF having recently connected to TMX Atrium’s network, and high frequency traders wishing to continue their practices without disruption from other technology firms and regulators, a move in the opposite direction appears to be emerging, with this recent full acquisition of Turquoise being no exception.