The Moscow Exchange , which operates a number of markets including for derivatives, and for foreign exchange, today updated the public as to the reason for the trading interruption that caused the exchange operator to suspend trading last night for its Derivatives market.

Forex Magnates reporters confirmed with a MOEX company spokesperson that currency trades were not affected as they are traded on different platforms which are not inter-connected, with FX traded on the FX and Precious Metals market. Last month MOEX had volumes in its FX Market surge on RUB volatility, and more and more brokers are starting to offer currencies such as the CNH and RUB, of advanced emerging market economies.

Shortly after 21:43 Moscow Time (MSK) yesterday, MOEX had published the initial update advising participants that trading on its derivatives market was suspended pending an investigation into the cause of the outage, it then resumed trading and said, "Derivatives Market trading resumed at 23:00 MSK. The trading system is now available for order withdrawal."

The initial investigation seems to have concluded with MOEX just issuing the following update today, "On 17 April, an error occurred in the core of the Derivatives Market’s trading system during the evening session at 9:29 pm MSK, resulting in the suspension of trading. The error occurred while processing a service transaction updating cash limits. To resume trading, exchange staff rebooted and conducted pre-launch testing of the trading system’s core. The system was open for order cancellation from 10:30 pm MSK, trading was resumed at 11:00 pm MSK, and proceeded to the close normally. As a precaution measure, Exchange operators enabled additional logging of certain operations in the system."

While the disruption was blamed on the error tied to the updating of cash limits as part of the service processing issue, at least the matter wasn't tied to a rouge algo as already enough scrutiny is on markets following the latest book on the subject by Michael Lewis that has caused the subject of HFT and its effect on participants as being questionable, and after the notorious flash-crash that caused a market anomaly and highlighted the needs for preventative measures against such events.

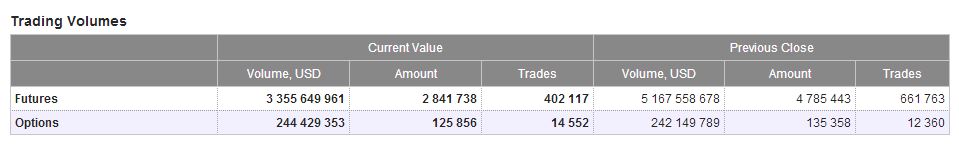

For MOEX the exchange apologized for any inconvenience, in its update, and as per information listed on its website trading volumes today appear to be back towards normal levels compare with yesterday's close: