Concluding a year in which a considerable amount of merger and acquisition activity took place, NASDAQ OMX has arrived at the very end of the year by announcing its purchase of an equity stake in Turkish executing venue Borsa Istanbul.

According to NASDAQ OMX, Borsa Istanbul entered today into an agreement with NASDAQ OMX in exchange for 5% equity, which includes the delivery of technology, following initial talks which commenced in the summer of this year.

Integration of Technology

A major facet of this particular corporate alliance is to provide various technology solutions to Borsa Istanbul, comprising Genium INET suite and all associated platforms and applications, with regional resell rights and also eventual self-sufficiency for Borsa Istanbul.

Further, the parties are to work closely together to cement Borsa Istanbul's position and brand as the capital markets hub for the Eurasia region, serving global issuers, investors and corporations.

As part of the agreement, NASDAQ OMX will take a five percent equity stake in Borsa Istanbul, with an option to increase this by an additional two percent; NASDAQ OMX will also receive a series of cash Payments . The parties' forward cooperation pathway may also include a minority participation by Borsa Istanbul in NASDAQ OMX.

This particular transaction was completed with agreement between the two parties that an option to raise the stake which NASDAQ OMX holds in Borsa Istanbul to 7%, although the period of time which should elapse before this can take place has not been disclosed.

Certainly NASDAQ OMX has been looking toward furthering its presence in Eastern Europe, a region which is of importance to firms based in Turkey, in September having connected to MarkitSERV for clearing connectivity to to assist with financial transactions performed on exchanges, mainly located in the Nordic and Eastern European regions.

The rationale behind this particular move demonstrates the firm's interest in building a capital markets hub for the Eurasia region, whilst gaining regional reselling rights and the ability to develop multiple new platforms.

Unification Of A Venue - A Potted History

Forex Magnates spoke today to Yunus Oguszhan Aloglu, Director of Precious Metals & Diamond Markets at Borsa İstanbul, who explained how the integration of the Istanbul Gold Exchange's operations took place subsequent to its merger with Borsa Istanbul.

"The trading volume of the precious metals market depends on local jewellery and investment demand which are affected by seasonal demand and international gold or silver prices. As a former gold exchange we used to have a 24 hour, 7 day per week trading system through internet-based access," he said.

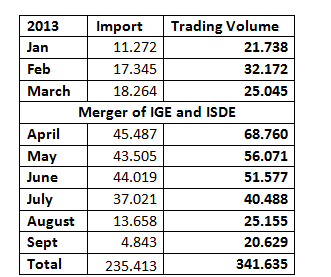

"By the time that the merger came about, our trading and clearing systems have been harmonized with Borsa Istanbul trading systems. The raise in the gold import and transaction volumes starting from April 2013 mostly stems from the sharp drop of gold prices which has triggered gold demand," continued Mr. Aloglu.

When asked by Forex Magnates to detail the current status of the integration, and if it had been completed, Mr. Aloglu said "was established on April 3, 2013 through the merger of Istanbul Gold Exchange and stanbul Stock Exchange under the provisions of the Capital Market Law No. 6362."

"As per the legal entities of Istanbul Stock Exchange and Istanbul Gold Exchange were merged and terminated upon the registration of incorporation of Borsa Istanbul A.Ş., all assets, and liabilities, all records of both Exchanges are deemed to have been transferred to Borsa Istanbul."

Subsequent to the merger of the two venues, Mr. Aloglu considered the most important steps to have been the harmonization of data processing systems and the legislation of the exchanges.

Nomenclature was important, and the former Istanbul Gold Exchange was renamed as Precious Metals and Diamond Market, and became a department under the entity of Borsa Istanbul. The data processing systems have been completely adjusted to the new organization. The legislation of the markets and the memberships are on harmonization process.

"As a direct result of the merger between IGE, Istanbul Gold Exchange, Turkdex, the Turkish Derivatives Exchange and Istanbul Stock Exchange, a newly structured Exchange, Borsa Istanbul (BIST) has replaced all the exchanges of capitals markets in Turkey," said Mr. Aloglu today.

Multi Asset Exchange

"The new structure is expected to bring positive effect and synergy to the financial system and capital markets with a more transparent, efficient and competitive environment for the capital markets in Turkey, increase the numbers and types of institutional investors. It is aimed to be a multi-assets exchange, and to provide worldwide developed trading platforms to the investors."

In ascertaining the importance of operating as one single exchange, Mr. Aloglu explained to Forex Magnates that "By the consolidation of the exchanges, investors and market participants will be able to access a wider range of financial products in a single Exchange environment which will result in cost savings and efficiencies. In this manner we are honored to be part of this big structure with many dynamic components contributing Istanbul to be a global financial center."

As a former Gold Exchange, Mr. Aloglu explained that the venue had had 3 markets in that particular guise. These consisted of the precious metals, precious stones (including diamonds),and the precious metals lending market.

Mr. Aloglu explained the current structure post-merger insofar as that, "Borsa Istanbul Precious Metals and Diamond Market consists of 3 sub-markets which are positioned within these sectors. The precious metals market has been the most active among these 3 sub-markets."

"We have been working on reviewing and renewing the regulations to activate the other sub-markets under the Precious Metals Market. There have been meetings with our members and market participants for both diamond and precious metals lending market for having a more efficient and active trading environment. We expect to achieve further steps in the future to realize the desired Liquidity levels in the Diamond Market and Lending Market."

"Besides the above mentioned issues, there are also some other projects we have been working on to establish in the Exchange such as base metals market, LOCO Istanbul transactions," concluded Mr. Aloglu.

"We are delighted to have put in place a highly impactful global partnership with NASDAQ OMX, anchored on the objective of together serving the financial community worldwide," stated Dr. Ibrahim M. Turhan, Chairman and CEO of Borsa Istanbul in a public commentary on behalf of the venue.

"I am confident that our combined team, powered by one of the most advanced technology suites available in the world today, will consistently offer cutting edge trading facility, innovation, platform breadth, and flexibility to customers worldwide," he concluded.

Bob Greifeld, CEO of NASDAQ OMX made a corporate statement today that the company is "Pleased to be working side-by-side with Borsa Istanbul as they evolve toward becoming an international hub that will attract global investors to the Eurasia region."

"Building and powering the world's capital markets is at the heart of NASDAQ OMX's Global Technology Solutions business, and we are thrilled to be partnering and investing in the Turkish exchange."

Borsa Istanbul Trading Volumes 2013

"This new partnership is a milestone for our market technology business," added Lars Ottersgård, Senior Vice President and Head of Market Technology, NASDAQ OMX.

"By delivering our entire suite of technology solutions, including our advisory services, to Borsa Istanbul we show the depth and breadth of NASDAQ OMX's global offering. Establishing global capital markets is core to NASDAQ OMX's mission and we are pleased to be Turkey's partner in building efficient and effective functioning markets," is Mr. Ottersgård's perspective on how this will assist with furthering NASDAQ OMX's network.