Heightened volatility in financial markets today brought benefits to a number of exchange operators in terms of trading volumes as new record-highs were made at exchanges such as BATS across Europe, and trading products from the CBOE and CME in the U.S., following the global reaction to the UK's Referendum result.

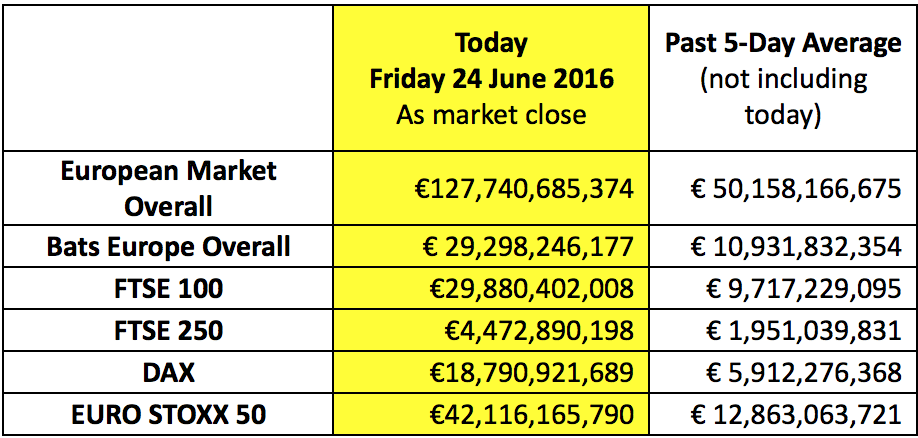

Europe’s largest exchange operator, BATS, shared with Finance Magnates that it recorded a new record with €127.7 billion worth of stock traded across Europe today, roughly 2.5 times higher than its prior five-day trailing average.

The new world of Online Trading , fintech and marketing – register now for the Finance Magnates Tel Aviv Conference, June 29th 2016.

BATS surpasses prior volume record

The new record surpassed BATS’ prior record in Europe which was reached on August 25th of last year when it saw €114.3 billion worth of stock traded, with today’s volumes higher by nearly 11.7% or €13.4 billion than its last high. An excerpt of trading volumes from BATS can be seen in the table below for this Friday June 24th 2016, across Europe:

Source: BATS Europe

While several indices closed down by double-digit percentage points, and wild swings occurred in foreign exchange markets, trading volumes have skyrocketed in certain instruments.

Foreign exchange volumes were said to have tripled today, according to comments by Tom Keene speaking live on Bloomberg Radio during this Friday’s afternoon trading session in New York.

New records at CBOE and CME

The Chicago Board Options Exchange (CBOE) in the U.S. today noted that VIX Futures traded during the non-US hours hit a new record as 235,000 contracts were estimated to have been traded as per an official statement from the company.

VIX Futures trade on the CBOE Futures Exchange, offering traders the ability to speculate and/or hedge on volatility, independent of market direction, and measure the volatility as a gauge of implied volatility sentiment.

Preliminary data from the Chicago Mercantile Exchange (CME) this morning, showed that futures on the UK pound (GBP) were already at 425,000 contracts, surpassing the exchanges last record of 342,501 contracts reached on September 10, 2014.

Finance Magnates reported yesterday when the CME expanded its circuit breakers to accommodate greater swings which indeed followed into today’s historic volatility – as the GBP made its largest single day move ever. A person familiar with the matter confirmed to Finance Magnates that a number of circuit breakers were triggered but CME’s FX markets continued to trade as designed.

The Berlin Stock Exchange, also known as Deutsche Berlin, reportedly set a new record high for volumes on one of its venues.While the increased volumes help exchanges earn more fees, the risk-off positioning that may have been set in place today can lead to thinner volumes as investors move into other assets.

Aftermath still not fully known

Many trillions of dollars were depleted from the valuation of securities today globally, due to a broad stock market sell-off after Brexit , yet holders of puts or those with short positions in related assets that fell in value would have benefited, while sellers of those puts could have suffered losses.

Similarly, wild swings in currency markets are soon likely to reveal tremendous profit/loss ramifications for investors, traders, corporations, and other holders of foreign currency exposure during today's market turbulence.

A number of brokers were relieved to have reported that they were not affected adversely by the abnormal market conditions, as noted by Finance Magnates in related posts, since the UK voted yesterday to leave the EU.

While the increased volumes help exchanges earn more fees, the risk-off positioning that may have been set in place today - with a broad market selloff seen in equities - can lead to thinner volumes. In addition, investors may move into other assets, including commodities, or pause for any further context of the Brexit effect and any related contagion in markets.