The New York Stock Exchange (NYSE) Euronext reported its trading volumes for December 2013, revealing a comprehensive listing of its global derivatives, Forex , and equities exchanges, via an announcement today from the NYSE Euronext.

The NYSE Euronext (NYX) is a leading global operator of financial markets – in particular the entity acts as a holding company and a cross-border foreign exchange group created by the combination of the NYSE Group Inc. and Euronext N.V. back in 2007. An overview of the report reveals some telling figures, highlighted by the global derivatives average daily volume (ADV) of 5.9 million contracts (excluding Bclear) in December 2013 decreasing -7.6% YoY and -10.8% MoM.

European Cash Equities Outperform American Counterparts

Furthermore, U.S. equity options volumes also experienced a notable decline across the board in December, incurring a -13.2% drop YoY, and a -9.9% decrease MoM. December proved to be a mixed bag in regards to the ADV across U.S. cash equities with YoY volumes crumbling -8.7% - alternatively, volumes grew 0.9% MoM. Moving to the European side of the operation, European cash equities performed much better than their American counterparts with December ADV yielding a 13.6% growth YoY, compared to a 9.3% increase MoM.

NYX European Derivatives Mixed In December

NYX European derivatives products came in at 2.4 million during December, marking a 1.5% growth YoY, however under the lens of a MoM timeframe suffered a -13.3% drop.

Including Bclear, NYSE Liffe’s Trade administration and clearing service for their suite of OTC products, European derivatives ADV declined -11.3% YoY and -3.9% Mom respectively. The total MSCI World Index yearly volumes fostered an uptick of 31% to 337,000 lots in December 2013, coupled with open interest of over 110,000 lots – a sizable increase of 245% YoY.

NYSE U.S. Options Exchanges Cedes Overall Share, Shrinks To Just 24.5% Of Trading

NYSE Euronext U.S. Cash equities options (representing the combination of NYSE Arca and NYSE Amex Options) ADV reported 3.4 million contracts in December 2013, shrinking -13.2% YoY and -9.9% MoM respectively. Furthermore, the NYSE Euronext U.S. options exchanges accounted for just 24.5% of the overall U.S. consolidated equity options trading in December 2013, a knock down from its 27.2% total YoY, and also down from 26.0% MoM.

NYSE Liffe U.S. Contracts Decline -10.0% YoY

NYSE Liffe U.S. ADV of nearly 65,300 contracts declined -10.0% YoY to 72,600 contracts, however MoM increased from 32,000 contracts. Meanwhile, 2013 ADV MSCI futures are up 71.0% YoY, while year-end OI notched a gain of 48.0% YoY.

European and U.S. Cash Products A Mixed Bag

NYSE Euronext European cash products ADV numbering 1.2 million transactions in December 2013 swelled 13.6% YoY, despite a decrease of -9.3% MoM. Alternatively, the U.S. cash products (NYSE, NYSE Arca, and NYSE MKT) dealt with an ADV of 1.4 billion shares in December 2013, culminating in an -8.7% drop YoY, but edging out a slim 0.9% increase MoM.

NYSE Euronext’s Tape A matched market share in December 2013 was calculated at a 31.0% share, which decreased from 31.9% YoY – this does register as an improvement however from 29.5% MoM.

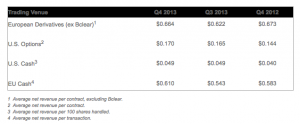

Lastly, the report details specifically the preliminary average net revenue per transaction type for each of the primary trading venues for the fourth quarter ending 2013, listed below: